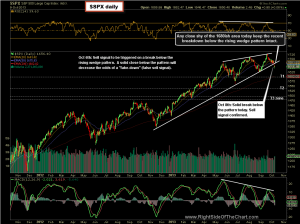

Currently the $SPX futures are trading around 1667, which would indicate a decent gap up at the open of the regular trading session today. Even with the pending gap higher today, the $SPX still has a decent buffer zone before the recent powerful sell signal via Tuesday’s rising wedge pattern breakdown is undone (by prices moving back within the wedge). As of today, the uptrend line that defines the bottom of the pattern comes in just shy of the 1680 level. Therefore, only a solid move AND CLOSE above the 1680 level today would undo the recent sell signal from the breakdown of that pattern. Being as near-term oversold as we are, a counter-trend bounce is not surprising. Also keep in mind that backtests of recently broken wedges, should we get one today, can last for several days at times as prices crawl along the bottom of the wedge or make a 2nd or 3rd kiss of the pattern from below before turning down. My expectation is for a very short-lived rally and as such, I will be fading today’s gap but I do not plan to add any more short exposure after that until/unless I see prices start to rollover, preferably after a full backtest of the pattern. This updated $SPX daily chart was made before the open today and as such, reflects yesterday’s closing values.

Currently the $SPX futures are trading around 1667, which would indicate a decent gap up at the open of the regular trading session today. Even with the pending gap higher today, the $SPX still has a decent buffer zone before the recent powerful sell signal via Tuesday’s rising wedge pattern breakdown is undone (by prices moving back within the wedge). As of today, the uptrend line that defines the bottom of the pattern comes in just shy of the 1680 level. Therefore, only a solid move AND CLOSE above the 1680 level today would undo the recent sell signal from the breakdown of that pattern. Being as near-term oversold as we are, a counter-trend bounce is not surprising. Also keep in mind that backtests of recently broken wedges, should we get one today, can last for several days at times as prices crawl along the bottom of the wedge or make a 2nd or 3rd kiss of the pattern from below before turning down. My expectation is for a very short-lived rally and as such, I will be fading today’s gap but I do not plan to add any more short exposure after that until/unless I see prices start to rollover, preferably after a full backtest of the pattern. This updated $SPX daily chart was made before the open today and as such, reflects yesterday’s closing values.