If at first you don’t succeed…

If at first you don’t succeed…

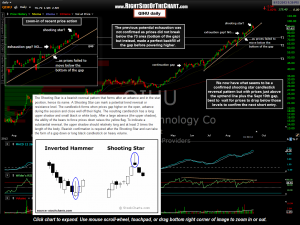

QIHU was a recent short trade (and/or untriggered setup, as dual entry criteria were posted). That trade was based of what was referred to as a potential exhaustion gap pending confirmation via a move below the 73 area, which would have brought prices below the bottom of the Aug 26th gap and greatly increased the odds that the gap was indeed an exhaustion gap. However, QIHU instead make a text-book backfill, kissing the bottom of that gap before reversing and continuing higher, going on to take out the suggested stop of a move somewhat above the Aug 27th highs.

Fast-forward a couple of weeks and we once again have what looks to be a likely, fairly high probability candlestick reversal pattern. On Wednesday, QIHU put in an inverted hammer candlestick, aka as a Shooting Star when such a candlestick is formed after an extended run. In order to confirm that potential reversal candlestick, additional bearish confirmation is required such as the two days of impulsive selling that immediately proceeded the shooting star so far. However, as with the previous short, which I suggested waiting for either a move below the previous gap (key support) before an entry for conventional traders or before going to a full position for aggressive traders who shorted in anticipation of a confirmed reversal pattern, I would also suggest the same with this trade. As QIHU sits slightly above both the orange uptrend line as well as the recent gap up from Tuesday of this week, best to wait for prices to move somewhat below that gap (which will also have taken out the trendline). Therefore, QIHU will trigger a new short entry on any intraday break below the 85.85 area (0.06 below the bottom of the gap, to give a slight margin of error in case of a brief overshoot on a back-fill of the gap). Price targets are listed on this updated daily chart with the exact suggested buy-t0-cover levels to follow if the setup triggers an entry.

Keep in mind that many of the short & intermediate-term trend indicators have flipped back to bullish after just recent going to sell signals. Those sell signals may prove to be whipsaws (false signals) if the market continues higher or they may prove to be valid signals with a brief false buy signal to the upside if the market reverses and continues lower soon. Bottom line is that regardless of numerous red flags, most trend indicators are now back on buy signals (short, intermediate & long-term) and as such, short trade should be considered counter-trend trades and therefore, aggressive trades suitable for more experienced & nimble traders.