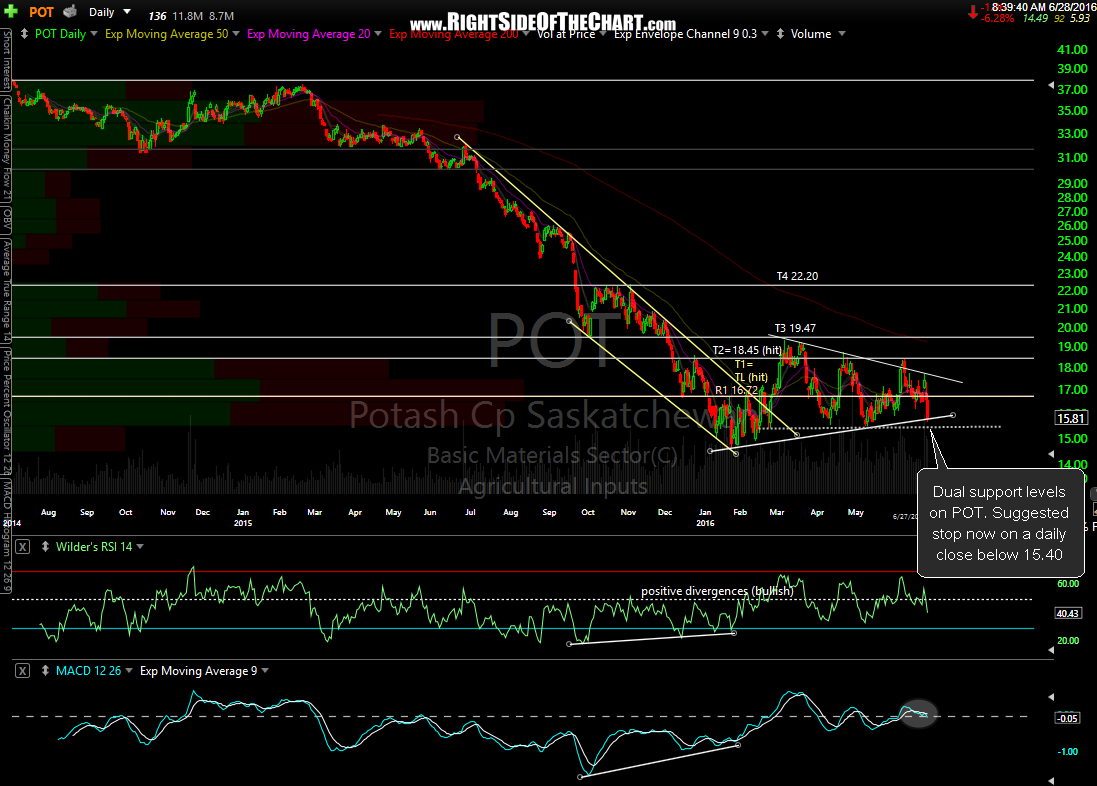

The POT (Potash Corp.) Growth & Income Trade closed right on the bottom of a symmetrical triangle yesterday, which is uptrend line support. In order to protect profits or assure only a minor loss on this long-term swing trade/growth & income trade, the suggested stop will now be raised from a weekly close below 14.90 to a daily close below 15.40.

POT was added as a Growth & Income Trade on January 13th at 15.77, paying out a dividend of 0.25 on May 3rd which reduced the cost basis on this trade to 15.52. The next dividend of 0.25 is scheduled to be paid around August 2nd to shareholders of record on July 12th (which will reduce the basis on the trade to 15.27 if the trade is still active as of July 12th).

This update on POT was prompted by a inquiry on the MOS & POT trades from member @ixtlanian in the trading room today, my reply below:

Yes, they both are at or just above key supports. I’ve been watching them as they are both still Active Growth & Income Trades and I own both in several long-term accounts as well.

My preference (assuming that I didn’t already have a position) would be to wait to see if the market’s negative reaction to Brexit proves to be fleeting & the market shows signs of stabilizing over the next week or so. However, for someone with a bullish outlook on the market, going long here at support with a stop not too far below certainly seems objective although again, I wouldn’t do so primarily because of my intermediate & longer-term bearish market bias.

As MOS & POT are the only two Active GR & INC trades right now, I’ll post an update with the support levels that I’m watching along with updated suggested stops. Thanks for mentioning those & g-luck if you are currently long or plan to go long.

note: The MOS trade was updated earlier under a separate post, as to associate each trade with its unique symbol/ticker tag for archiving purposes.