I received the follow question regarding my take on crude oil & as I haven’t posted any commentary on crude lately, I figured the response was worth sharing:

Q: Would really appreciate your views on crude oil at this time Has struggled around 60-62 for the past few weeks. Is it worth shorting as up today over 60?

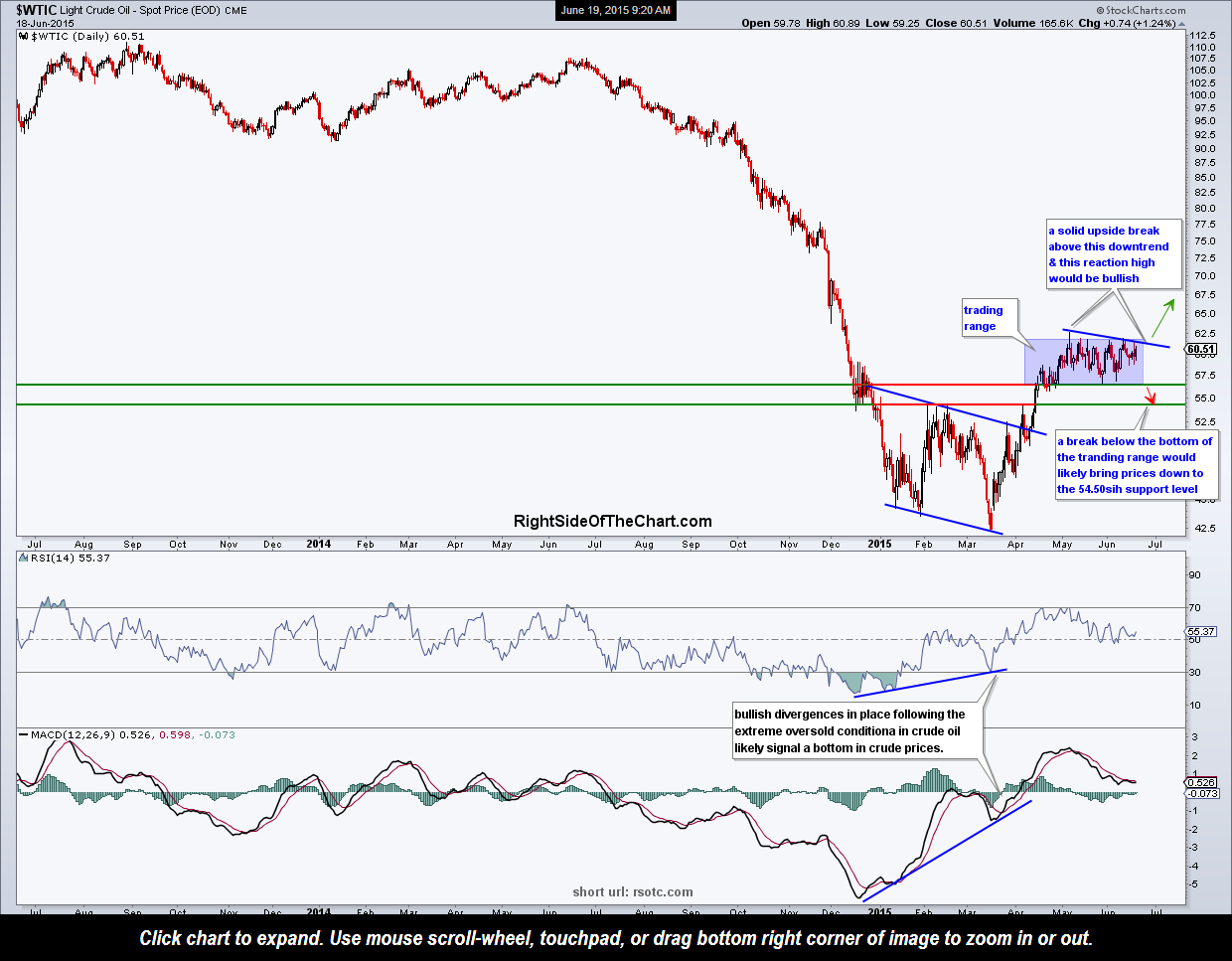

A: I don’t have much of an opinion on crude oil, if any at all right now, especially as to where it goes in the near-term. Like you mentioned, crude has been in a sideways trading/consolidation range pretty much since mid-April and when I look at the charts, I just can’t get a solid read on where it is likely headed next. Being that crude is near the top of its recent trading range (although that ceiling isn’t as well defined as I’d like to see), I guess that one could establish a short position here with a stop somewhat above or even slightly below the recent highs or the downtrend line off the May 6th lows, targeting either the bottom of the recent trading range OR holding in anticipation of a downside break of that range, which would likely bring prices down the 54.50 support level.

Static chart below. Click here to view the live, annotated daily chart of $WTIC (this is an end-of-day chart)