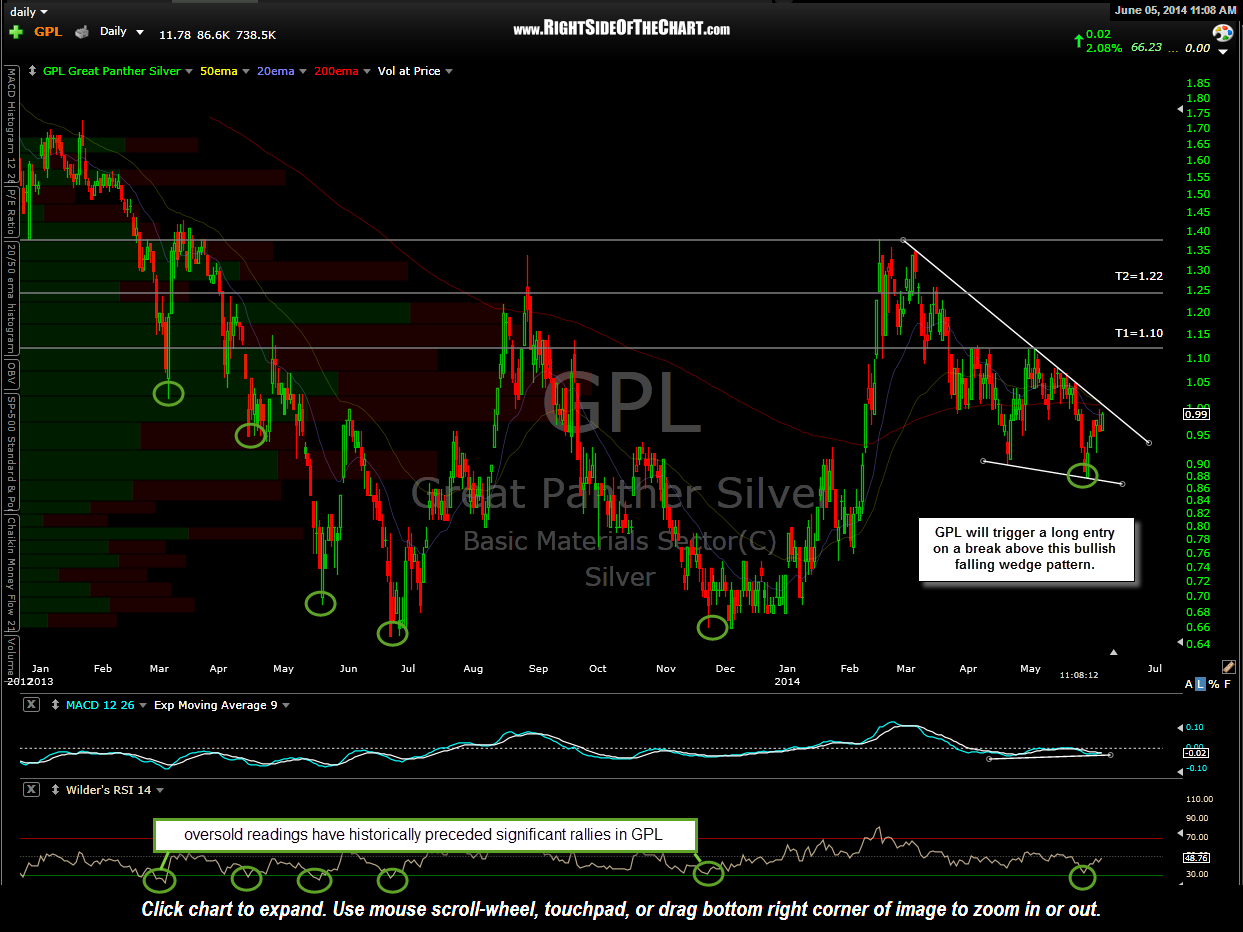

GPL (Great Panther Silver) will trigger a long entry on a break above this bullish falling wedge pattern. Note how the previous oversold readings, 5 in total last year, all lead to significant rallies in this mining stock. With prices having already rallied about 12.5% since the recent oversold reading and considering where prices are now in relation to the wedge formation, GPL could possible make one more pullback within the wedge before breaking out. With prices currently just below the top of the wedge pattern, if a breakout does occur before then my preference will be to only take a fractional position, adding on a pullback and/or backtest of the wedge.

When determining position size or whether to even trade individual mining stocks at all (based on one’s risk tolerance & trading style), a trader should also consider the increased risk & volatility of trading low priced stocks in addition to the unusually high volatility inherent to the gold & silver mining stocks. Less experienced or more risk-adverse traders and investors wanting exposure to the sector might consider using the diversified ETFs such as GDX, SIL, GDXJ, etc.. Other than very short-term trades (measured in days, not weeks or months), it is probably best to avoid using the leveraged sector ETFs such as DUST & NUGT due to the price decay on leveraged ETFs, particularly those tracking volatile sectors.