GCAP (Gain Capital Holdings Inc) has hit the sole profit target for a 21.2%. This follows the 25.3% gain in the stock less than a year ago. As the first target was the first of either the downtrend line on the 2-hour chart (which was hit today) or the 9.00 horizontal resistance area, this trade will now be considered completed. However, GAIN is currently trading up about 12% on the day as I type and has exceeded the uptrend line by a fair margin, thereby increasing the odds that the 9.00 resistance level will be reached. For those who wish to hold out for additional gains, consider raising stops to protect profits and setting your sell limit order just shy of the 9.00ish resistance level (say around 8.94) in order to help minimize the odds of missing a fill, should the stock reverse just shy of resistance.

- GCAP daily- Dec 18th (entry)

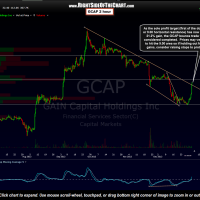

- GCAP 2-hour Dec 18th (entry)

- GCAP daily- Jan 3rd (target hit)

- GCAP 2-hour Jan 3rd (target hit)

This trade is a good example of a “catching a falling knife” trade. Although the trade was entered while prices had fallen to the primary uptrend line on the daily chart, stops were placed somewhat below that level as the downside momentum on the stock was very strong at the time. As such, an overshoot of the uptrend line was likely. Zooming into the 2-hour chart, we could see that there was also decent horizontal support around the 7.06 level. Therefore, the suggested stop of slightly below 7.00 allowed for a little wiggle-room and keeping us in the trade as the stock went as low as 7.03 on the overshoot.