There really hasn’t been any new significant technical developments in the markets since my last update. Despite yesterday’s big move higher, which of course followed Monday’s sizable drop, the broad market (S&P 500) is only about 1.25% above the level it was trading when I published the February 25th Market Update Video. The recent action has been very choppy & virtually untradable as about 70% of yesterday’s 1.53% gain in the S&P 500 was due to the gap (i.e.- not providing an objective entry for longs who weren’t already positioned) in addition to nearly all of Monday’s 3/4th % drop coming from the gap down.

The mining stocks continue to flounder around my second target zone and although I have not yet begun to add back exposure to the sector yet, many of the individual mining stock trades may have now pulled back or consolidated enough to have worked off the overbought conditions that were are result of the sharp move in the sector from mid-Dec to late Feb. Several mining stock trades were updated earlier today although email notifications were not sent out as most of those trades had hit a profit target a few weeks ago and were updated in the Feb 14th post titled Reducing Exposure to the Gold Mining Sector. I will continue to work on updating the remaining mining trades as well as all other active trade ideas, which I hope to have updated by the end of the week. At that point, my focus will return to finding new trade ideas.

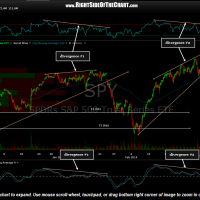

Overall, I continue to believe that the R/R is currently skewed to the short side although I would like to see some technical evidence before adding much more short exposure. On these 60 minute charts of the SPY & QQQ, we can see that both key indices have put in higher highs while the MACD & RSI have failed to do so, i.e.: negative divergence. More often than not these divergences play out in the form of a correct, such as the 5-6% drop in late Jan/early Feb.

- SPY 60 minute March 5th

- QQQ 60 min March 5th

Again, we need to see some additional evidence to help solidify the bearish case as all trend indicators are currently bullish. We did print an inside day on both the small caps ($RUT/IWM) & midcaps ($MID/MDY), which is a start but an idea scenario would be a gap down in the SPY & QQQ below Tuesday’s lows to put in an island cluster reversal pattern. Of course that’s only one of many possible scenarios and I will update any significant technical developments as I come across them. Good Trading. -RP