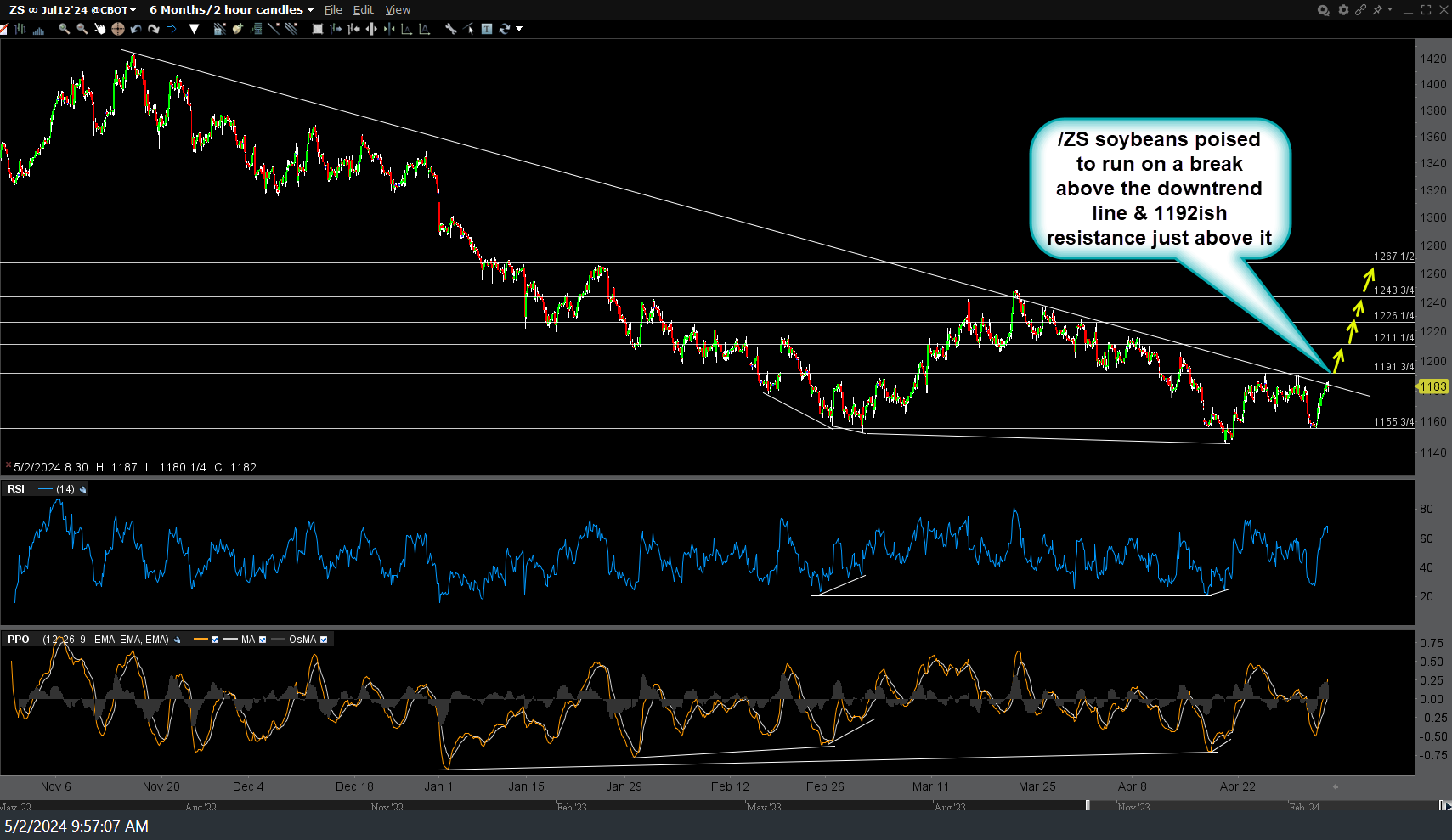

/ZS (soybeans futures) appears poised to run on a break above the downtrend line & 1192ish resistance just above it. 120-minute chart below.

For those that prefer exchange traded products over futures, SOYB (soybeans ETN) recently broke out above & successfully backtested this downtrend line & offers an objective long entry here, although one could also wait for a break above the downtrend line & 1192 resistance on /ZS (soybean futures) before taking a full position. Daily chart below.

I’ll follow up with the charts & trade updates on the other two grains, wheat & corn, in separate posts. There used to be an ETN (JJG, iPath Bloomberg Grains ETN) that tracked all 3 but it was redeemed by the issuer along with a handful of other agricultural commodity tracking ETN’s last year. As such, one would have to go long all three futures contracts or ETNs (wheat, corn, & soybeans) if wanting full & ‘diversified’ exposure to the grains.

However, all three typically move roughly in tandem so the “diversification” thing is more so a bullish bet on the grains while spreading your bets as it is hard to predict which one(s) will outperform the others, assuming we are still in the early stages of the next leg up in their new bull market that started back in 2020, as I’ve made the case for in recent years. Of course, positions in any or all of the grains is certainly part of a broader diversified portfolio spread across various unrelated asset classes such as stock, bonds, plus various hard & soft commodities with little to no correlation.