Despite crude prices rallying over 10% in the same time period, XOP is only up about 3% since the 4/29 short entry. As I had apparently neglected to list a suggested stop earlier, the official stop for the XOP/GUSH trade will now be set to any move above today’s high of 38.28.

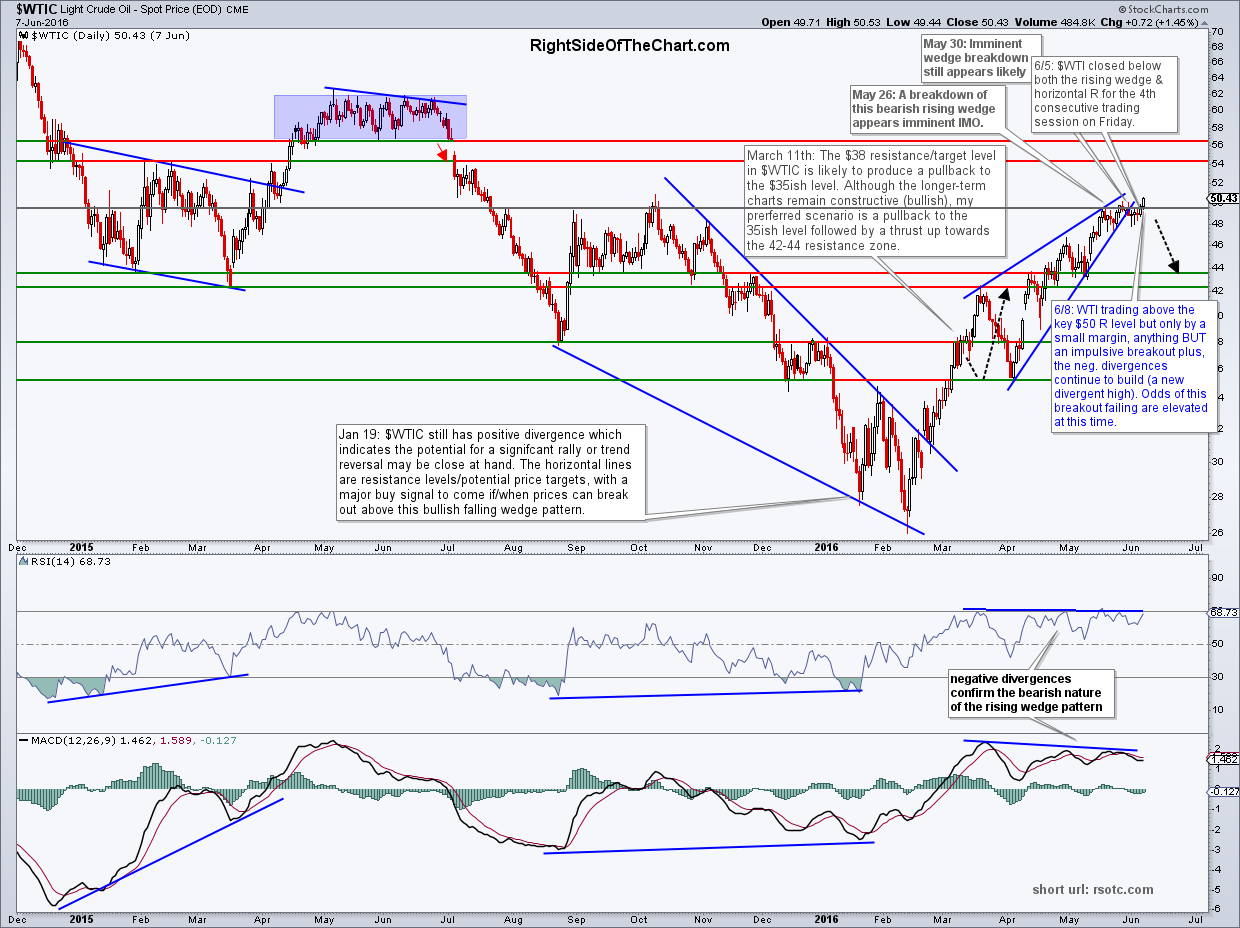

Despite the recent new reaction highs in crude & XOP, I still believe the odds are good that XOP will reach the final target (T2 at 31.77) before taking out today’s earlier highs. An update of XOP would be incompletely without taking into account the technicals on crude oil. $WTI is currently trading above the key $50 R level but only by a small margin on anything BUT an impulsive breakout, not to mention the fact that the negative divergences continue to build (a new divergent high). As such, I believe that the odds of this recent breakout in both crude & XOP failing are elevated at this time. Of course I may be wrong & if so, that’s what stops are for. My apologies for neglecting to list a suggested stop earlier.