Due to AAPL’s recent death spiral, XOM has once against reclaimed it’s previous distinction of being the largest company by market capitalization. With the heaviest weighting in the S&P 500, the performance of Exxon Mobil Corp can have a significant effect on the broad market.

Due to AAPL’s recent death spiral, XOM has once against reclaimed it’s previous distinction of being the largest company by market capitalization. With the heaviest weighting in the S&P 500, the performance of Exxon Mobil Corp can have a significant effect on the broad market.

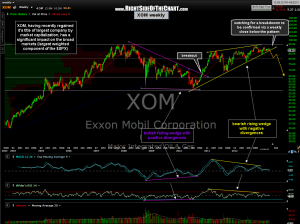

Here’s a weekly chart of XOM showing prices perched in a very precarious position, resting on a key uptrend while approaching the apex of this large bearish rising wedge pattern. Note how this rising wedge pattern, like the previous bullish falling wedge pattern before it, is confirmed by clear divergences in place on the MACD and RSI (as well as some other indicators and oscillators not shown here). Also note that prices failed to make a new high in the attempt back in late October, so far putting a double-top in place on this leading stock.

Due to the large weighting and effect that XOM will likely exert upon the major indices, this post will be categorized in both the General Market Analysis category as well as a Short Setup. As this is a weekly chart, best to wait for a solid weekly close below the bottom of the wedge for confirmation of a breakdown before exiting any long-side trades or initiating a short entry. I’ve have some general support levels shown on this chart but I plan to update the trade setup with some official targets and stop criteria soon.