My focus today & into next week will be on posting updates on the existing trade ideas, both official & unofficial, as well as looking for new trade ideas. Two of the recent official short trades have exceeded their suggested stops & will now be reassigned to the Completed Trades archives.

XLY (Consumers Discretionary ETF) slightly clipped the suggested stop of any move above 117.50 before drifting back to close at 117.36 yesterday, resulting in a 5.3% loss on the trade. As the technical posture of the sector still indicates that a odds of significant correction remain high in the coming weeks to months, some might opt to give this one a little more on their stops, especially if targeting T3 but the official trade is now closed as the maximum suggested stop was hit.

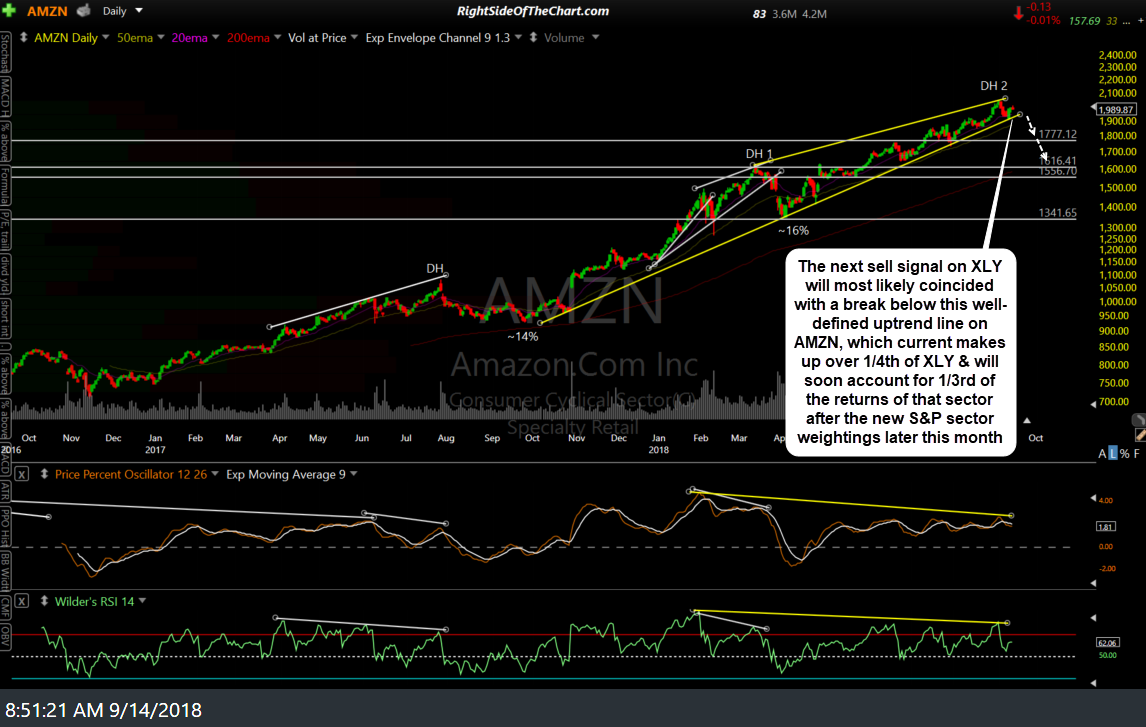

In hindsight, I had jumped the gun on the XLY short as the next sell signal on XLY will most likely coincide with a break below this well-defined uptrend line on AMZN, which currently makes up over 1/4th of XLY & will soon account for 1/3rd of the returns of that sector after the new S&P sector weightings later this month.

ITA (Aerospace & Defense Index ETF) was stopped out for a 7.1% loss on the Aug 28th close of 208.84 & is also under consideration for another possible swing short trade depending on how the charts of that sector & its top components develop going forward.