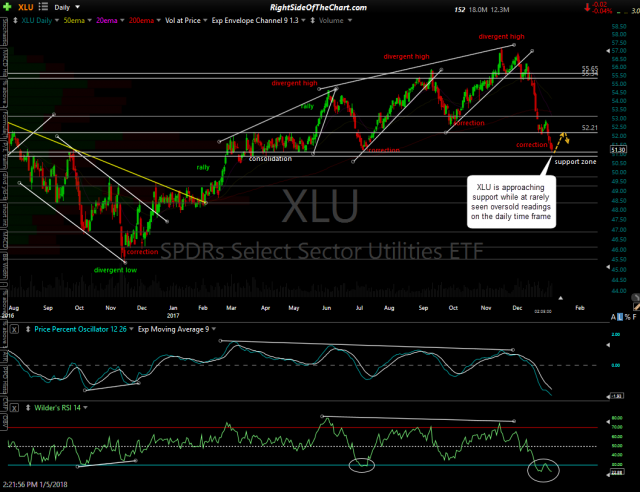

XLU (Utilities ETF) will be added as an Active Long Swing Trade here in anticipate of a breakout above this bullish falling wedge pattern as prices approach support on the daily time frame while the utilities stocks are at rarely seen oversold levels.

- XLU daily Jan 5th

- XLU 60-min Jan 5th

The sole price target for this trade is 52.54. Due to the relatively low volatility/risk associated with utility stocks coupled with the fact this is only intended as a quick “oversold bounce off support” trade with a relatively small gain/loss potential, the suggested beta-adjusted position size for this trade is 2.0 (i.e. – 2x a typical position size).

The gain potential (unadjusted) on this trade is 2½% which translates into a 5% gain potential when accounting for the oversized position. The stop was calculated using a 3:1 R/R (i.e.- 1 unit of loss risked per 3 units of profit potential). One could also use normal (1.0) position size of UPW, the 2x bullish utilities ETF, in lieu of XLU although UPW is not a liquid as XLU & as such, the spreads are currently about 10 cents vs. 1 cent on XLU.