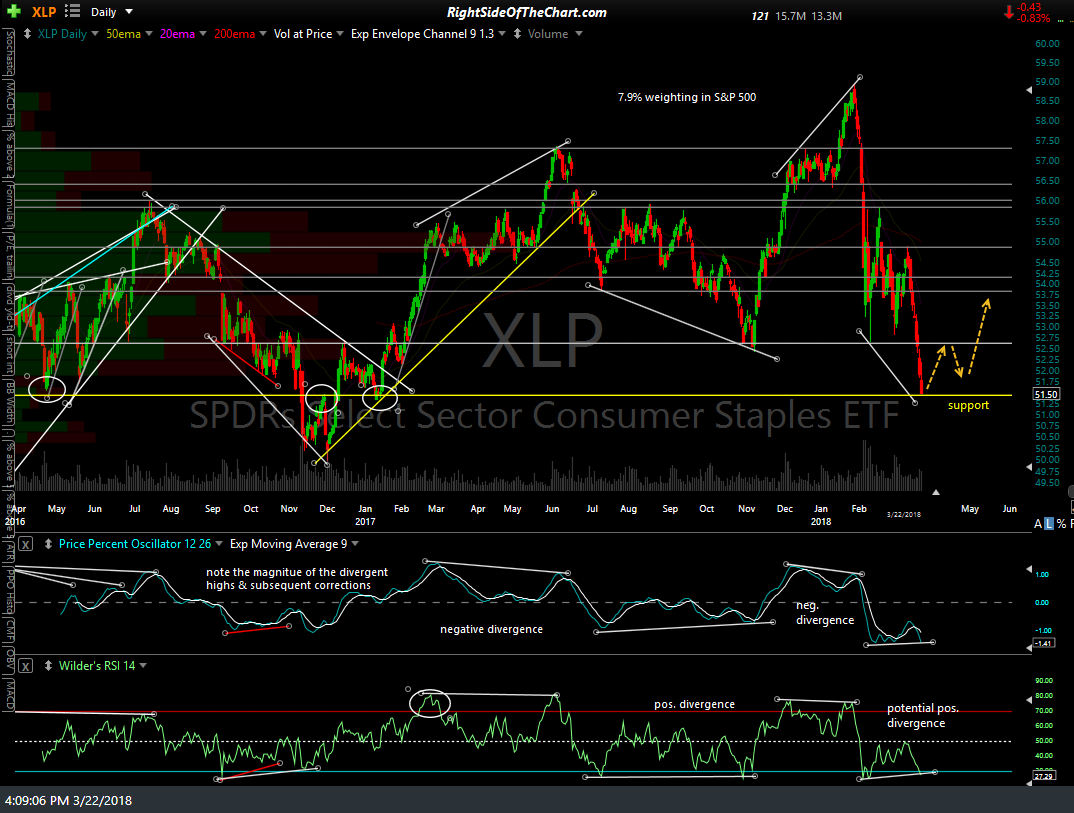

In reviewing the charts of various stocks & sectors shortly before the close, I had noticed that the utilities sector ETF (XLU) was trading positive on the day as well as TLT (long-term Treasury Bond ETF), an indication that institutions are pulling money out of tech & rotating into defensive sectors & asset classes. That prompted me to check the charts of XLP (consumer staples ETF) as well as some of the top components of that defensive sector ETF.

Normally, entries for official trade ideas are published well in advance of the market close or as trade setups, with entries to be triggered on a pre-determined price level or trendline breakout. In the case of XLP, I wanted to get the trade idea out before the close, which I just managed to do by a couple of minutes, in order to allow for anyone interested to take a position if they like idea of going long a relatively low-risk sector that has the potential to outperform the broad market in the coming weeks to months, should we see a continued rotation out of growth stocks & sectors like technology, biotech, etc. with some of those funds moving into defensive sectors & safe haven assets like treasury bonds.

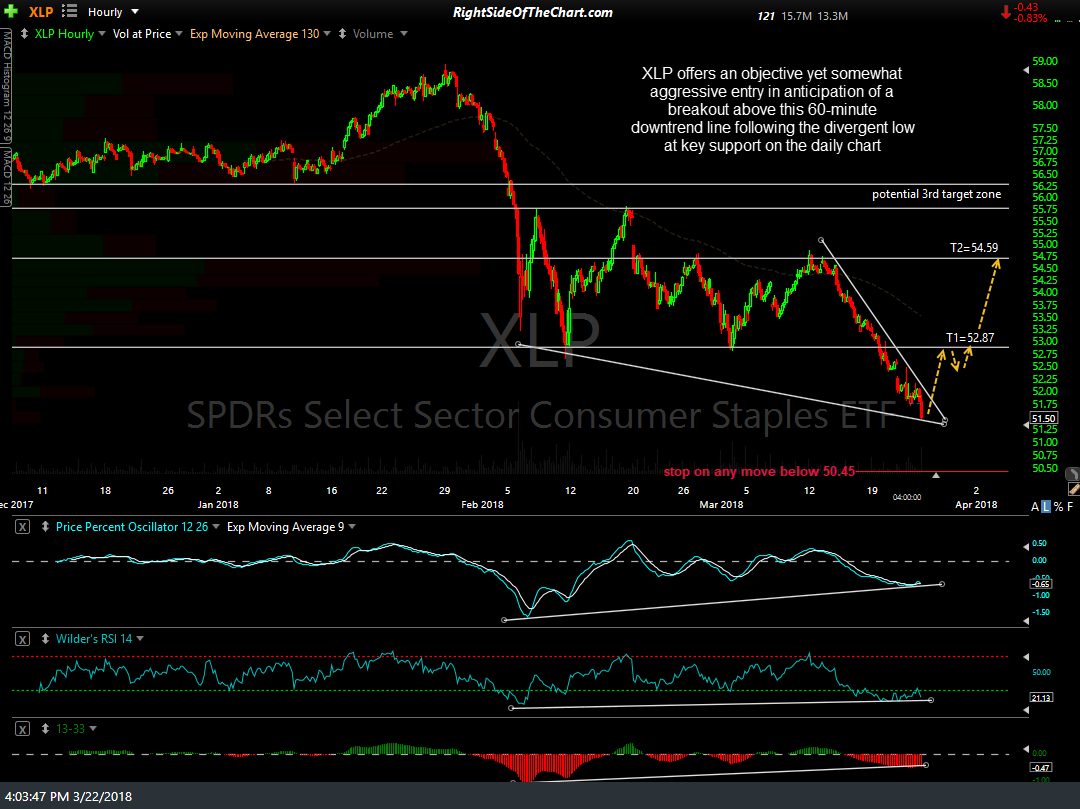

As a popular, widely-held ETF, XLP trades fairly actively in the after-hours trading session with relatively tight spreads. As I type, XLP is trading at 51.45 x 51.52 so one could enter an order to buy at, say, 51.50 or so, and have a good chance of getting filled at the same level XLP closed at today. The price targets for this trade are T1 at 52.87 & T2 at 54.59. The suggested stop (calculated using an R/R of roughly 3:1 if targeting T2) is any move below 50.45. The suggested beta-adjusted position size for this trade will be 1.0.

A few other considerations on this trade are the fact that a long position in an oversold, defensive sector like consumer staples meshes with my preference to not only strive to keep a balance of both long & short trade ideas on the site at most points in time but also to provide for various sectors & assets classes with little to no correlation such as stocks, bonds & commodities, in order to allow for both active traders as well as longer-term investors the tools to help build a diversified, all-weather portfolio.

The gain potential for this trade, assuming that it is not stopped out first, is minimal compared with the majority of trade ideas posted on RSOTC & depending on how the charts of both XLP & the broad market develop in the coming days & weeks, I may decide to revised T1 to the final target instead of T2. If so, that would result in a rather paltry gain of less than 3% but as there is a large subset of traders & investors that do not have the desire or comfort level to short stocks & ETFs, I’m passing this along as one of the more attractive sectors within the S&P 500 for a long-side trade at this time. As with any trade idea shared here, pass if this one does not mesh with your unique trading style, risk tolerance & objectives.