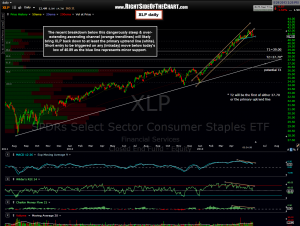

As a well-diversified ETF in a stable industry, XLP is a relatively low risk short setup which has a decent shot of playing out to at least the second target (T2), or roughly an 8% gain. The recent breakdown below this dangerously steep & over-extending ascending channel (orange trendlines) will likely bring XLP back down to at least the primary uptrend line (white).

As a well-diversified ETF in a stable industry, XLP is a relatively low risk short setup which has a decent shot of playing out to at least the second target (T2), or roughly an 8% gain. The recent breakdown below this dangerously steep & over-extending ascending channel (orange trendlines) will likely bring XLP back down to at least the primary uptrend line (white).

Short entry to be triggered on any (intraday) move below today’s low of 40.89 as the blue line represents minor support. Based on my interpretation of the weekly chart (not shown here), which is close to triggering a sell signal, XLP could potentially morph into a longer term swing short trade with additional targets being added later. For now, T2 (37.70 or the primary uptrend line, whichever comes first) remains the final & preferred target. Consider a stop above the recent highs of 42.19.