The XLE (1x energy sector ETF) short & ERY (-2x energy short/bear ETF) active swing trades offer very objective add-ons in pre-market as the energy stocks don’t yet appear to have fully priced in the current -4.5% drop in /NG natural gas futures and 4.2% drop in /CL crude futures, with XLE only trading down about 1.7% so far today in the pre-market session. Other than this current objective short entry or add-on in pre-market, the next sell signal & objective entry or add-on to the XLE/ERY short will come on a solid break below S1 (1st support level) of 87.86 on the daily chart below.

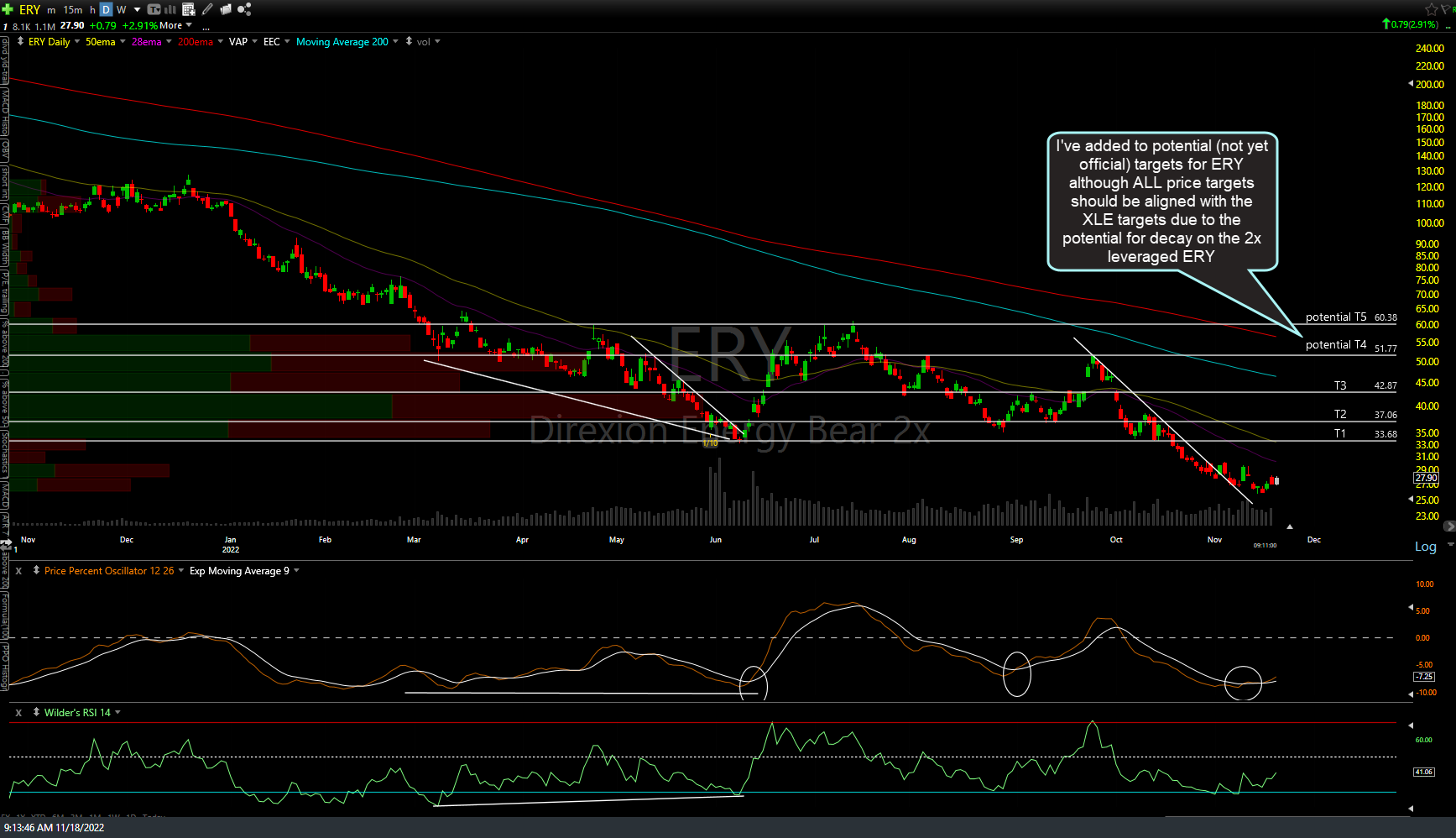

The price targets for ERY remain as previously posted but I’ve added two more potential (not yet official) targets for ERY although all price targets should be aligned with the XLE targets due to the potential for decay on the 2x leveraged ERY.