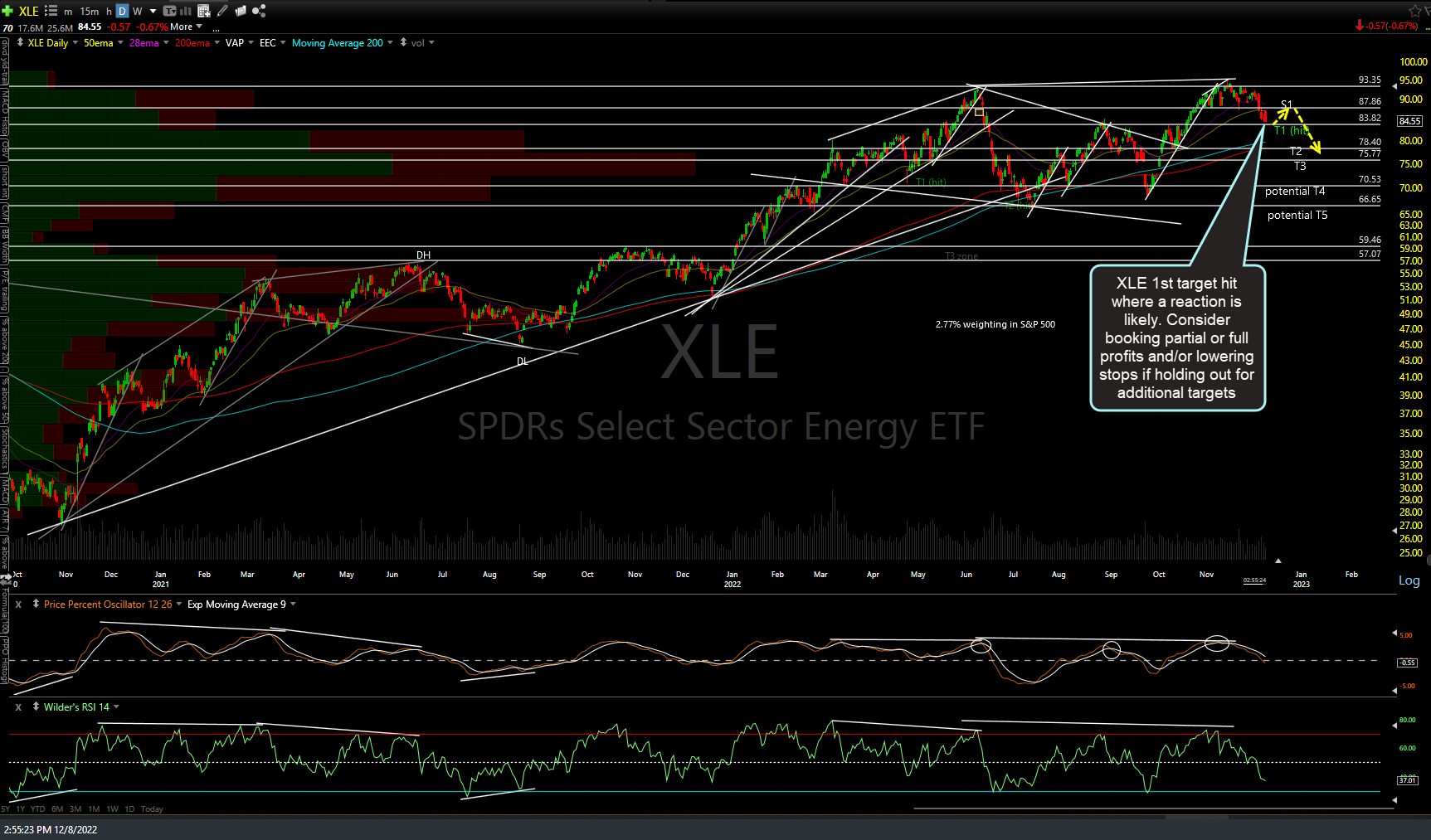

XLE (energy sector ETF) has hit the first price target* where a reaction is likely before the next leg down. Consider booking partial or full profits and/or lowering stops if holding out for additional targets. *Price targets on my chart are the actual support level where the odds are a reaction are likely & as such, it is always best to cover a short slightly above the actual support level in case the buyers step in early. As such, this is close enough to consider T1 hit. Daily chart below.

Likewise, the ERY (-2x bearish/short energy sector ETF) alternative proxy has hit its comparable first price target, which has been slightly revised to align with T1 on XLE. Consider booking profits or raising stops to protect gains if holding out for additional targets. I do think the odds for a decent bounce from at or slightly below current levels on XLE are pretty good at this time & as such, my preference is to book profits here & recycle back into a short on the energy stocks at the next objective entry, whether that comes as a bounce back into resistance or a continued move down that clearly takes out support, assuming the charts confirm at the time.