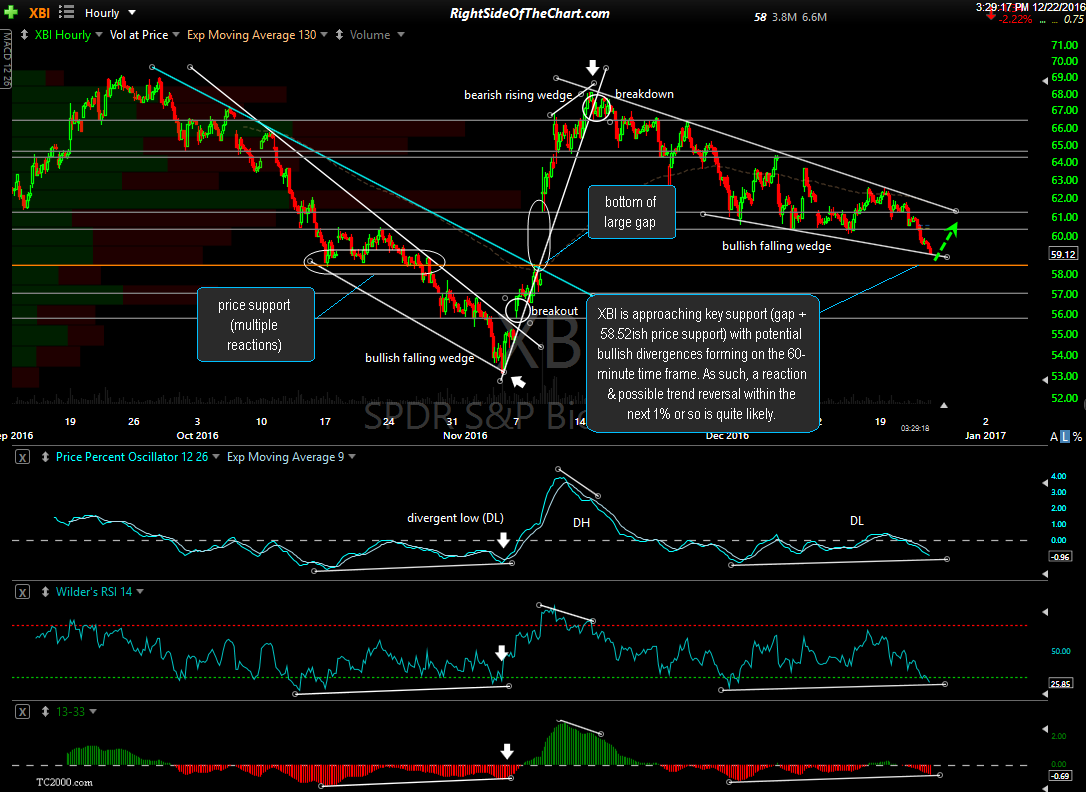

XBI (Biotech ETF) is approaching key support (gap + 58.52ish price support) with potential bullish divergences forming on the 60-minute time frame. As such, a reaction & possible trend reversal within the next 1% or so is quite likely.

Potential divergence means that the PPO (and the MACD) as well as the RSI are still pointing lower so those “potential divergences” will only be confirmed if both the PPO (or MACD) and RSI turn back up, putting a higher low (vs. the Dec 2nd previous reaction low) in place. Regardless of whether or not the divergence is confirmed, the odds for a reaction on the initial back-fill of a gap, especially large & fairly recent gaps such as this one from Nov 9th, are quite high.