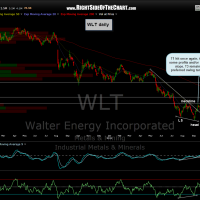

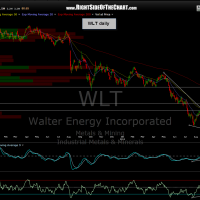

WLT was posted as a long setup on 9/12, broke above the bullish falling wedge the next day (9/13) on an impulsive move with above average volume, triggering an entry and then made a perfect kiss of T1 the next day (9/14). immediately after tagging the T1 level, prices pulled back to re-test the falling wedge pattern from above. after successfully testing the wedge for nearly two weeks, prices have now started moving impulsively higher again. therefore, WLT still looks to provide an objective long entry or add-on with the appropriate stops in place below. as the stock closed yesterday at roughly the same level of the 9/13 breakout, and considering the distance to T3 (my preferred target), i think an objective stop would be just below the 31.00 area. original & updated chart below.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}