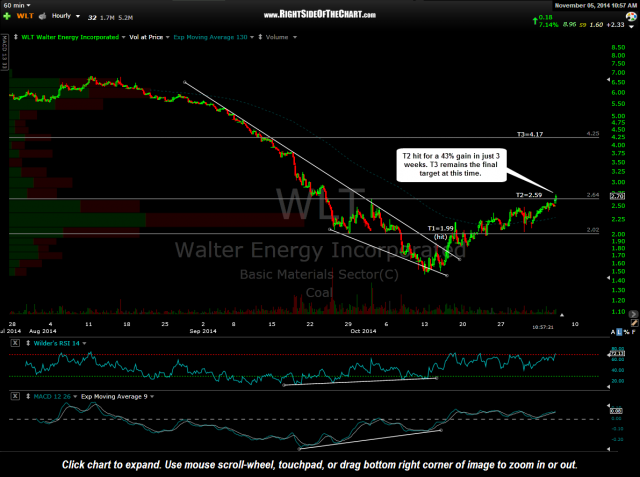

WLT (Walter Energy Inc) has hit the second price target, T2 at 2.59, for a 43% gain in just 3 weeks since entry. T2 was originally my preferred target although T3 (4.17) was listed as, and still remains, the final target on this trade at this time. A reaction (pullback and/or consolidation) would be expected around the T2 resistance area (2.65ish) but over time, WLT still has a good shot of reaching the T3 level and still has the potential to morph into a much longer-term swing trade/investment.

Other than the recent bullish technical developments highlighted on the coal sector and several of the individual coal companies, coal stocks are exhibiting very strong relative strength against crude oil lately (the two tend to move in sync) with many US coal stocks moving higher despite crude oil recently trading at multi-year lows. It is still to early to say with a high degree of certainty that the coal stocks have bottomed but the recent price action that comes on the heels of an absolutely brutal bear market, might be an indication that the coals stock are just plain sold out (i.e.- may have reached the point of seller exhaustion).