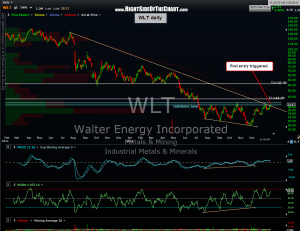

The WLT long setup has triggered the first entry (see previous post for preferred entry criteria) as it has taken out the bottom of the resistance zone. An ideal stop for this lot would be not too far below (1% +/-) the orange downtrend, should WLT want to backtest that large falling wedge pattern.

The WLT long setup has triggered the first entry (see previous post for preferred entry criteria) as it has taken out the bottom of the resistance zone. An ideal stop for this lot would be not too far below (1% +/-) the orange downtrend, should WLT want to backtest that large falling wedge pattern.

Just remember when the market momentum is this strong yet the indexes, as well as most individual stocks, are this overbought, taking new long positions (and staying 100% long) is like a game of music chairs. This market is so overextended that once the music stops, and it will, even if only for a few days, the ensuing pullback is likely to be sharp & possibly steep. I would consider being very selective on new long positions at this point and consider reduced position sizing and/or trailing relatively tight stops. Overbought can always get more overbought but the more the rubber band gets stretched, the harder it will snap back once the tide changes. There is nothing wrong with taking these long setups as they trigger, just don’t become complacent on your stops and/or consider booking some profits or scaling into some hedges (shorts) to reduce your net long exposure if you have not done so already.