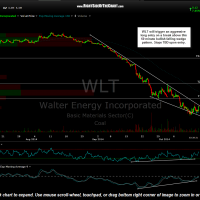

Wash. Rinse. Repeat. WLT (Walter Energy Inc) will once again be added as an aggressive Long Trade Setup on a break above this 60 minute bullish falling wedge pattern. T2 (2.59) is the current preferred target at this time with a final target (T3) at 4.17. Stops will be determined upon entry. As with the previous WLT long trade, Walter Energy, along with several other US Coal stocks, has the potential to morph into a long-term term trade or bottoming play. However, we just don’t have enough technical evidence at this time to make that case with a high degree of confidence although I have been observing some recent bullish price action in other coal stocks, such as ANR (also shown on the 60 minute time frame below, as this stock has recently broken above this descending price channel & will also offer an objective long entry once the 2.04 resistance level is clearly taken out). Target levels are marked but the suggested sell prices will follow.

- WLT 60 min Oct 15th

- ANR 60 min Oct 15th

On a related note, I wanted to clarify or really expand on my previous comments about hedging against short positions. For weeks now I have made a case for a reversal in the $USD and a bullish case for select commodities including gold/gold mining stocks, wheat, corn, soybeans and select US coal companies. I continue to believe that these are some of the most promising trade ideas heading into the 4th quarter & likely well into 2015 and as such, although they are not considered typical hedges against short positions in US equities, they very well could prove to be if things play out that way (dollar down, commodities up). That has certainly been the case recently with precious metals and those commodities (and commodity producers) exhibiting very strong relative strength against equities. In this sense, I am running a quasi-hedged portfolio or at least a long/short portfolio, since it is not directly hedged via equity index futures, call options or bullish ETFs against my short positions.