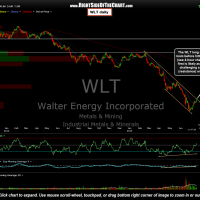

The WLT long trade, just like the CLF long, was added as a long entry on June 24th towards the bottom of a bullish falling wedge pattern in anticipation of a high-probability reversal & breakout of that pattern. As with CLF, WLT did reverse shortly thereafter and went on to break above the wedge. However, WLT has now run into a downtrend line (resistance) on the daily time frame and with this trade now up over 21% from entry, shorter-term/active traders might consider booking partial or even full profits as a pullback soon is likely. Longer-term traders & investors shouldn’t be overly concerned with short-term gyrations as this pattern still looks bullish longer-term. However, stops should be raised as this point, depending on one’s average cost. Posted below in the following order are the previous 4 hour chart, updated 4 hour chart and the updated daily chart:

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}