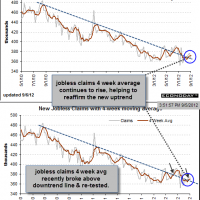

good news: jobless claims for the week of august 25th beat expectations, although only slightly by less than 1 1/2%, to come in at 365k vs expectations of 270k. the bad news? those expectations were already raised to a level above the average for the last few months. therefore, although not a huge increase, as you can see from the charts below the near-term trend (as measured by the 4 week moving average) continued to move higher on today’s release, also helping to reaffirm the potential recent primary trend reversal (downtrend line breakout & successful retest).

again, nothing earth moving or game changing in & of itself but more so when taken together with the many other recent deteriorating economic fundamentals that have been highlighted recently, such as GDP & manufacturing. this helps to affirm that the US, the lone pillar of strength in a deteriorating global economy, is finally showing some pretty clear signs that all this “decoupling” the media has been harping on is only an extension of the “hope” theme and not the reality that so many would like to believe. price action rules though and i am patiently watching the change of character in this market shift from the aggressive BTFD (buy the *** dip) pattern that persisted throughout most of august to the recent “go nowhere” back and forth action of the last two weeks. going forward, i will be on the lookout for any strong trend days. for example, can the market continue to build on today’s gap up and solidly move higher into the close or will this gap be faded again at some point during the day as has been the case with most gaps over the last couple of weeks? with the bollinger bands on the daily SPX pinching to levels not seen in years, this market is likely to explode one way or the other very soon so make sure to have a plan as well as contingency plans for whichever way things break.