VXX (Short-term $VIX ETN) will trigger a buy signal on a break above 26.89 with an alternative entry should it continue down towards the 21.40ish support level.

The price targets for this trade are T1 at 31.02, T2 at 35.53, and T3 at 42.94. The suggested stop is 24.00 with a suggested beta-adjusted position size of 0.60 due to the above-average gain & loss potential for this trade.

$VIX (CBOE Market Volatility Index) has triggered a buy signal on the recent breakout above this falling wedge pattern although at resistance now with the next buy signal/objective long entry to come on a solid break above 25.60. Keep in mind that you can’t trade the $VIX (spot VIX) directly, rather only via proxies that attempt to track the $VIX such as $VIX futures, options on those futures, and ETNs, such as VXX, that attempt to track the various futures contracts (e.g.- near-term, intermediate-term, etc…) Also, note the rallied that followed similar technical postures in the $VIX (breakouts above falling wedge patterns following divergent lows), most of which posted triple-digit gains in relatively short order.

Finally, the $VIX will typically trade inversely to the stock market, with those previous rallies highlighted on the chart above coinciding with corrections in the stock market. As such, sell signals on the major stock indexes, such as a sell signal on /ES (S&P 500 futures) which would come on a solid break and/or 60-minute close below this minor uptrend line, would to help to confirm an entry on VXX.

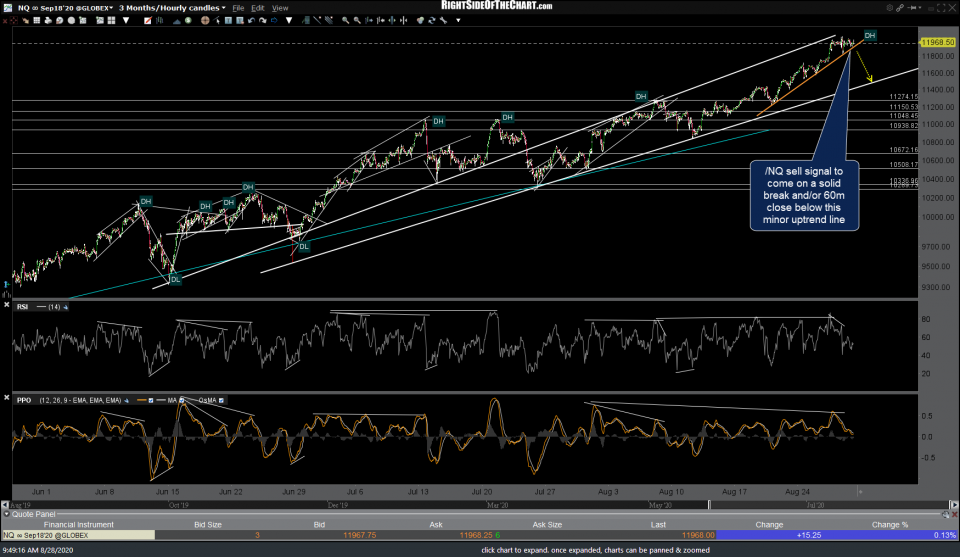

Likewise, a sell signal on /NQ (Nasdaq 100 futures) will come on a solid break and/or 60-minute close below this minor uptrend line.