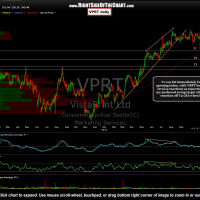

I’m working on updating some of the existing trades today, some of which may have hit a profit target a while ago, such as the VPRT (VistaPrint Ltd.) active short trade. VPRT is a swing short trade idea that was entered back in September (first chart below) & went on to hit the first profit target (T1) nearly 2 months later on Oct 30th. In the update posted that day, I stated: T3 remains my preferred swing target although another reaction off T2 (if & when hit) is likely. In reviewing the trade ideas today, I noticed that an update had not been made since. VPRT did go onto hit the 2nd target on Feb 5th and as expected, a reaction (bounce) in the stock immediately followed, just as it had immediately following the initial tag of the T1 level.

- VPRT Short Entry

- VPRT First Target Hit

- VPRT Second Target Hit

Although reactions (a bounce and/or consolidation) don’t always happen off each price target on a trade, more often than not they do. The trade ideas on Right Side of the Chart often list multiple price target for various reasons. For example, active traders may decide to micro-manage a trade by reversing a trade as each target level is hit (assuming that the shorter-term charts and other factors indicate that a reaction is likely at the time). Reversing a trade entails going long (if short) or short (if long) to attempt to gain additional profits from the counter-trend bounces within the primary trend of a trade.

Typical swing traders might use the various target levels to book partial profits or maybe go to cash/hedge a position in order to protect profits during the reaction (removing the hedges once the bulk of the bounce has likely run its course). Some traders might even choose to target only the first profit target, which of course has the highest probability of being hit, thereby booking quick profits and moving onto the next trade. There are many different trading styles and even my own style will vary from time to time (e.g.- very active trader/swing trader/trend trader) or depending on which account I am trading in and the objective for each trade (e.g.-my trading account which is used for active trading or my IRA’s in which most trades are long-term swing trades, trend trades and most of the trades from the Long-term Trade Ideas & Growth & Income Trades categories.)