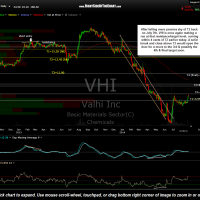

After falling mere pennies shy of T2 back on July 7th, VHI is once again making a run at that resistance/target level, coming within 4 cents of T2 earlier today while trading volumes have been increasing lately (a bullish sign). A solid break and close above T2 would open the door for a move to the 3rd & possibly the 4th & final target soon.

- VHI 60 minute Aug 22nd

- VHI daily Aug 22nd

There really aren’t many new developments to report on the markets or with the Long Trade ideas other than the fact that I plan to move to the PWE long trade to the Completed Trades category as it had exceeded its previously suggested stop (both a solid move & close below 7.40) the day after the last update on Aug 4th. All trade ideas, winners or losers, are updated when removed for archiving purposes but I need to post the PWE trade removal under a separately tagged post for categorical purposes (email notifications will not be sent as that will be an administrative & not a time-sensitive post). There are also several Active Short Trades that I plan to remove as they have either exceeded a suggested stop or no longer look compelling from an R/R perspective. Those closed trades will be sent out in a single post with any relevant notes on the individual trades & an email notification will be sent when posted.

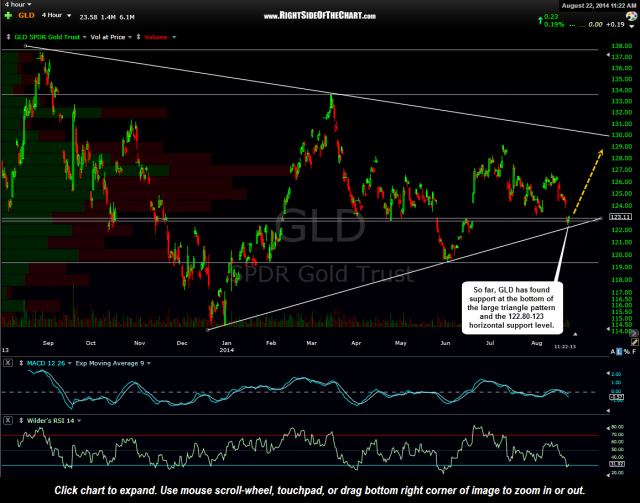

Other than the trade updates, I’m still watching GLD closely and so far, so good as GLD has found support just above the bottom of the symmetrical triangle pattern & the horizontal support zone posted on the 4-hour chart yesterday. My expectation remains that the near-term downtrend in gold prices will reverse soon with a resumption of the intermediate-term uptrend but we’ll most likely have to wait until next week to see if that is the case. As mentioned in last Thursday’s market update, my primary focus & positioning at this time is long gold & the mining sector in anticipation for the next major leg up (although I will start taking defensive measures/reducing my holdings should gold prices break the aforementioned support levels). Although I’m also positioned long with several other individual stocks and ETF, such as select commodity related ETFs, my overall positioning remains net short with a overweight on the regional bank sector & select financial stocks but as also mentioned in last Thursday’s market update, I do not plan to any more short exposure until/unless prices move back below the upper-most resistance levels (now support) covered in that post. Feel free to contact me if you have any questions regarding any of the Active Trades or Setups listed on the site at this time.