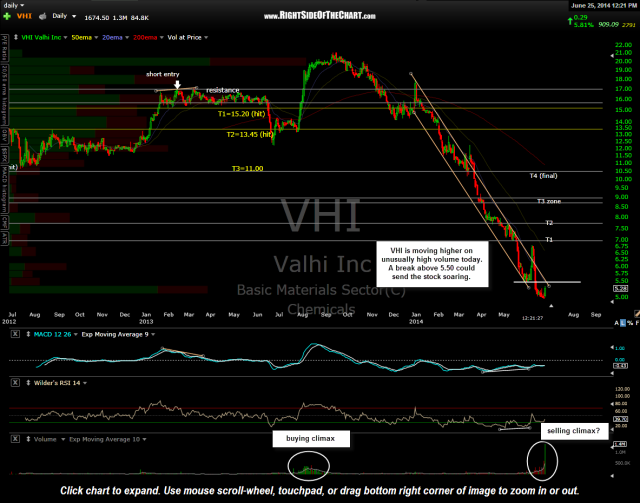

Although the VHI long was recently removed from the Active Trades category as it had exceeded the lower-most suggested stop, I’ve continued to monitor the stock and have noticed that it is moving higher on unusually large volume today. As mentioned in the previous update, the recent volume patterns are indicative of a possible selling climax, which could indicate a lasting bottom in the stock. As per the previous notes, this is an highly volatile, thinly traded stock that has been in a relentless downtrend, largely due to insider selling from the Harold Simmons foundation.

Harold Simmons was the company’s CEO who passed away in December. His foundation owns almost all the shares of VHI. From the looks of the recent continued selling by the Foundation, it appears that the supply/demand equation may have reached an equilibrium point around the 5.00 level as the continued insider selling in recent sessions has been met with nearly an equal amount of buyers to soak up the supply. Maybe this is just a temporary pause in the downward spiral of VHI although recent volume patterns may indicate otherwise. The previous trade was considered stopped out when it fell below the 5.50 resistance level, which is now resistance. As a break above that horizontal resistance level would also coincide with a break above the ascending channel on the daily chart, VHI will be added back as an aggressive long trade setup on a break above 5.50 with new price targets TBD if an entry is triggered. On a scale of 1-10 with 10 being the most aggressive, this trade would certainly be a 10 so as always, DYODD and consider adjusting your position size accordingly if you decide to take it.