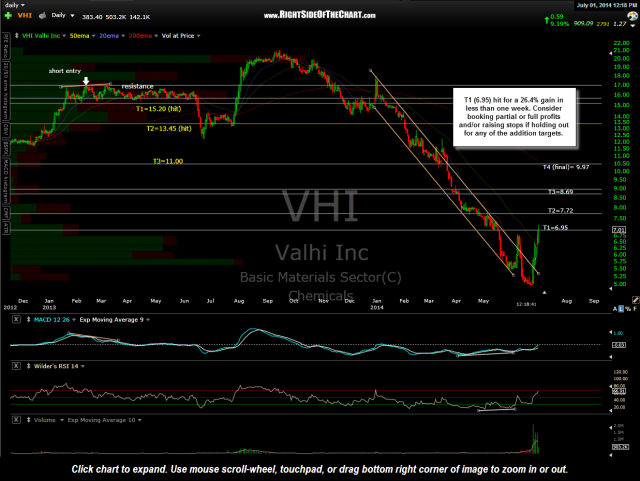

VHI (Valhi Inc) has now hit the first price target for a quick 26.4% gain in less than one week. Consider booking full or partial profits and/or raising stops if holding out for any of the additional targets.

For those new to Right Side of the Chart, multiple price targets are often used for the trade ideas to accommodate various trading styles (e.g- very active traders who prefer to book relatively shallow, quick profits & move on to the next trade; typical swing traders with holding periods measured in weeks or months; trend traders & investors who attempt to catch the bulk of a trend in a position, etc…).

Various criteria go into determining the price target levels such as significant price support/resistance levels, Fibonacci retracements, volume-at-price clusters, etc… Typically, price targets are set at level where a reaction (i.e.- pullback and/or brief consolidation period) is likely upon the initial tag of that level. Price targets (T1, T2, etc…) are usually set slightly below the actual resistance level for longs (slightly above for shorts) to help minimize the chances of missing a fill, should the position reverse just shy of support/resistance. Some traders might opt to book partial profits as certain targets are hit while very active traders might even micro-manage their trades around these levels (e.g.- reversing a trade from long to short at a target where a reaction is highly likely, then recycling back into the original direction of the trade either on the pullback or once that target level is cleared.)

Whatever your individual trading style is, the important thing is to have a trading plan in place for each trade which includes: How much capital you want to commit to the position; Whether you plan to scale into the position (average in) or take a full position upon your entry trigger; What your entry trigger will be; Your profit target(s) if the trade is successful as well as your stop level(s), if the trade does not pan out.