I was asked what I would do if VHI (Valhi Inc.) did not regain the 6.50 weekly support level by the close today (end of week) and this my response was this:

If it (VHI) doesn’t close above or at least fairly close to 6.50 tomorrow, I certainly won’t add any more but as long as the stock does not take out Wed’s lows I will most likely hold onto the small position that I have. Any solid break below Wed’s low & I’ll dump it but keep VHI on my radar for another possible long entry. This company has been around for decades & has a diversified product line (yahoo finance is good for a quick company profile, news & financials). I looked over the news & some fundamentals and don’t see anything that probably isn’t already priced into the stock.

Once again, I can not over-emphasize the risk involved with trading a low-volume stock that has been under relentless selling pressure with only the earliest technical evidence of a potential trend reversal. So far I like the action in VHI over the last few days but any move below Wednesday’s lows, where the stock hammered off the bottom of the steep descending channel on the daily chart, would certainly be a bearish event. For now, I’m still waiting watching to see if prices can move higher following that potential reversal stick. A break above the 7.00 area could be the catalyst for a move higher as that level is both minor horizontal resistance as well as just above the intersecting downtrend lines from the previously posted 120-minute charts.

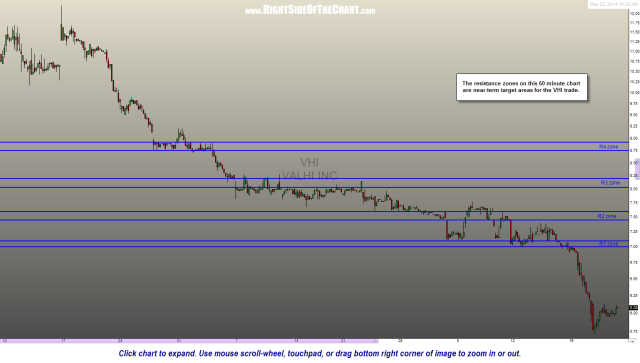

I’ve added a few initial target zones to this 60 minute chart of VHI. A potential, but not current, swing target, should VHI exhibit signs of a decent trend reversal soon, would be the 10.25 area. First things first though and that would be to see VHI continue to build on the gains since Wednesday’s lows, preferably on increasing volume.