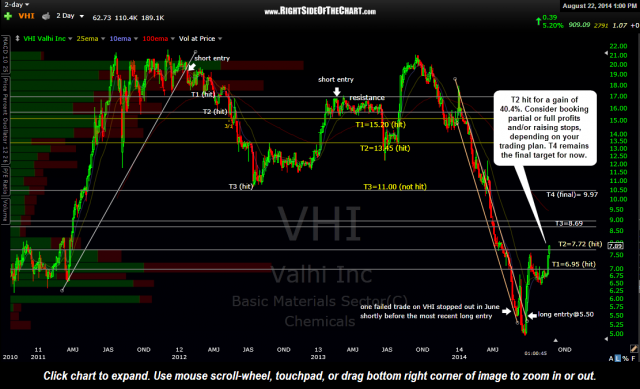

The VHI (Valhi Inc) long trade has now hit the second price target, T2 at 7.72, for a gain of 40.4%. Consider booking partial or full profits and/or raising stops, depending on your trading plan. As mentioned earlier, this recent move higher has been confirmed on volume with this most recent sharp move on increased volume actually starting the day before this bullish article from Zachs Equity Research was published. T4 remains the final target for now but again, consider at least raising stops to protect profits if holding out for T3 and/or T4. Longer-term traders might consider a stop below the lows put in earlier this month while more active traders might prefer more aggressive stops.

This 4-year, 2-day period chart shows the track record on VHI with 3 out of the 4 trades (including this one) being successful and all three producing gains well into the double-digits. The first short trade in early 2012 hit the 3rd & final target for a 41.3% gain in less than 3 months and reversed sharply upon reaching the final target level. The second & last trade on VHI, also a short trade, was initiated in early 2013 and hit the second target (T2) for a 19.7% gain and continued to fall about a third of the way to T3 before reversing. In late May, VHI was added as a speculative/aggressive long trade which was stopped out in June. VHI was once again added as an aggressive long entry on the breakout above 5.50 in late June and still looks promising from a longer-term perspective although the stock is quite overbought at this time.