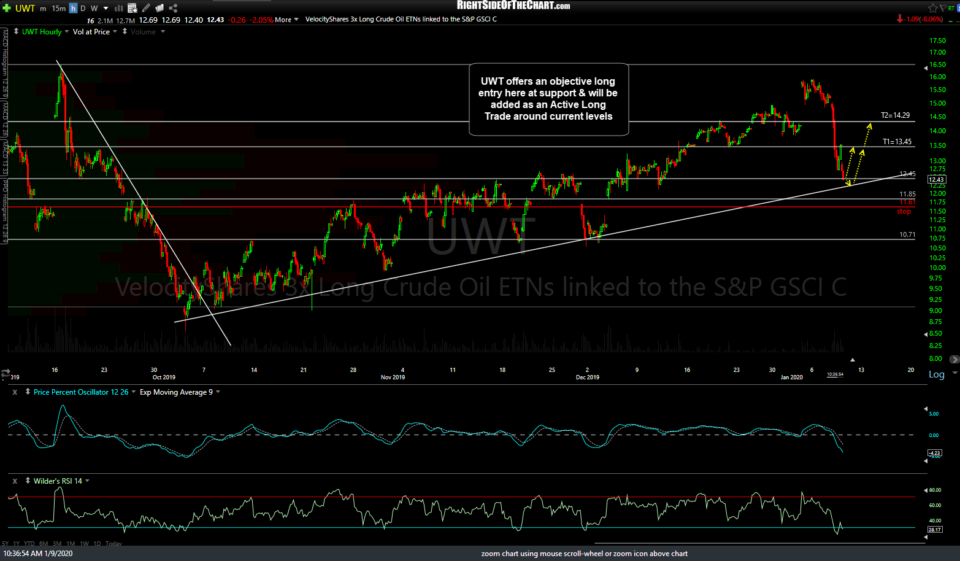

UWT (3x Long Crude Oil ETN) offers an objective long entry here at support & will be added as an Active Long Trade around current levels. The price targets are T1 at 13.45 & T2 at 14.29 with a suggested stop (if targeting T2) of 11.61. Due to the 3x leverage factor, the suggested beta-adjusted position size for this trade is 0.35%.

The primary basis for this trade is the fact that /CL (crude futures) is coming up on my final near-term target zone that I’ve been highlighting for weeks (the 58.69 support with primary uptrend line support just below) where a tradable bounce is likely. A video with a comprehensive analysis of crude oil & the energy sector ETFs: XLE, XOP, XES, DRIP, GUSH, etc., along with trade ideas & price targets on those as well, will follow shortly.