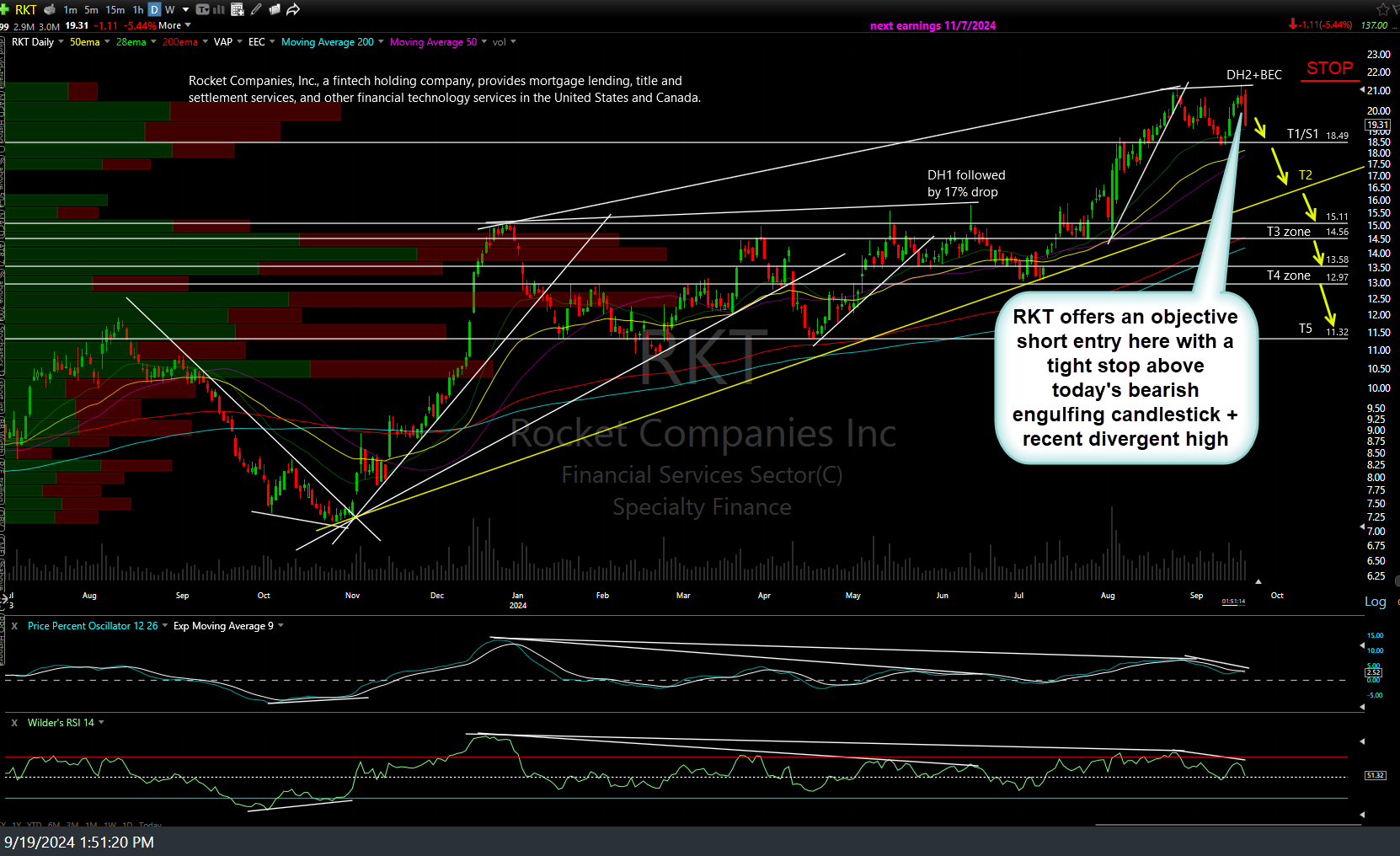

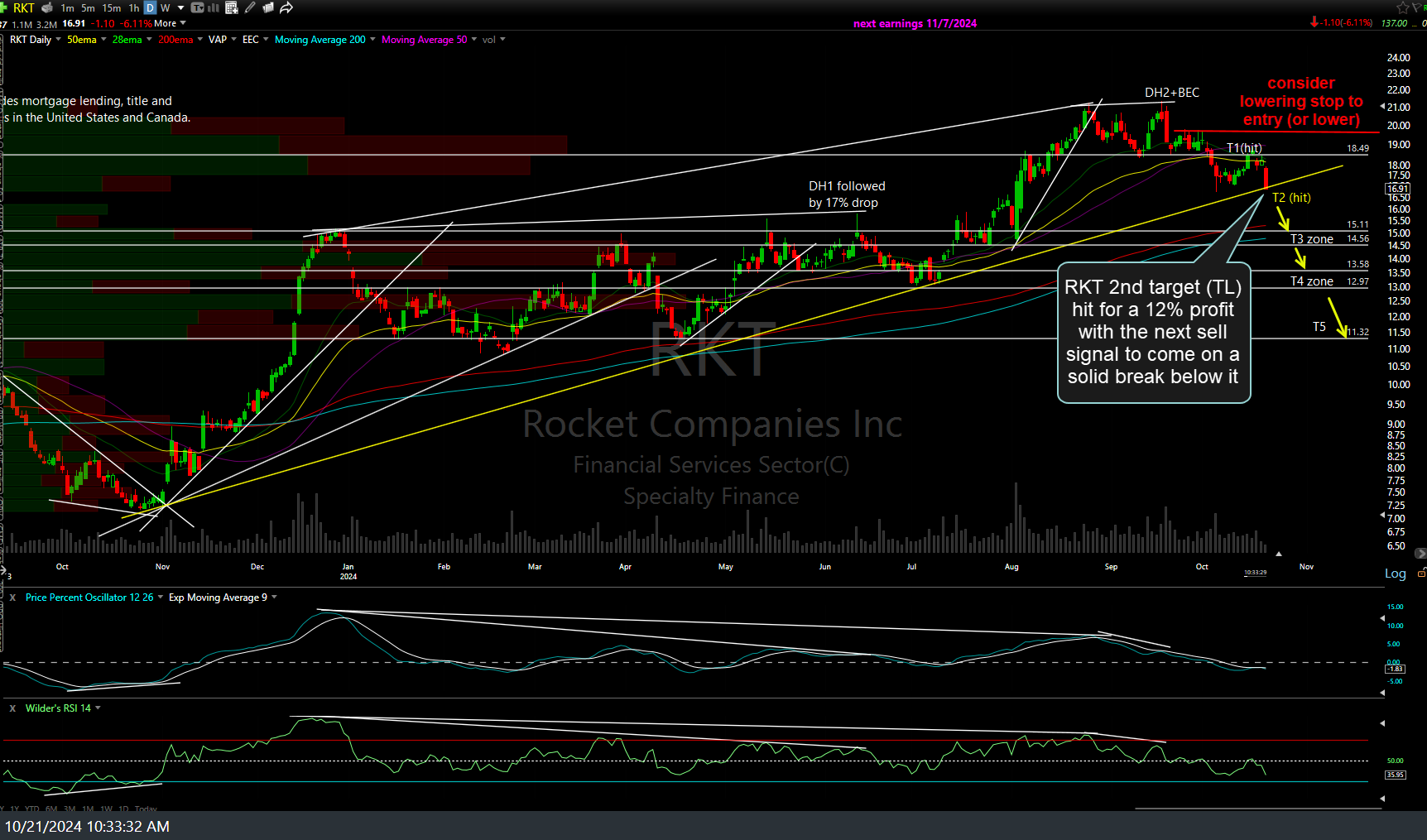

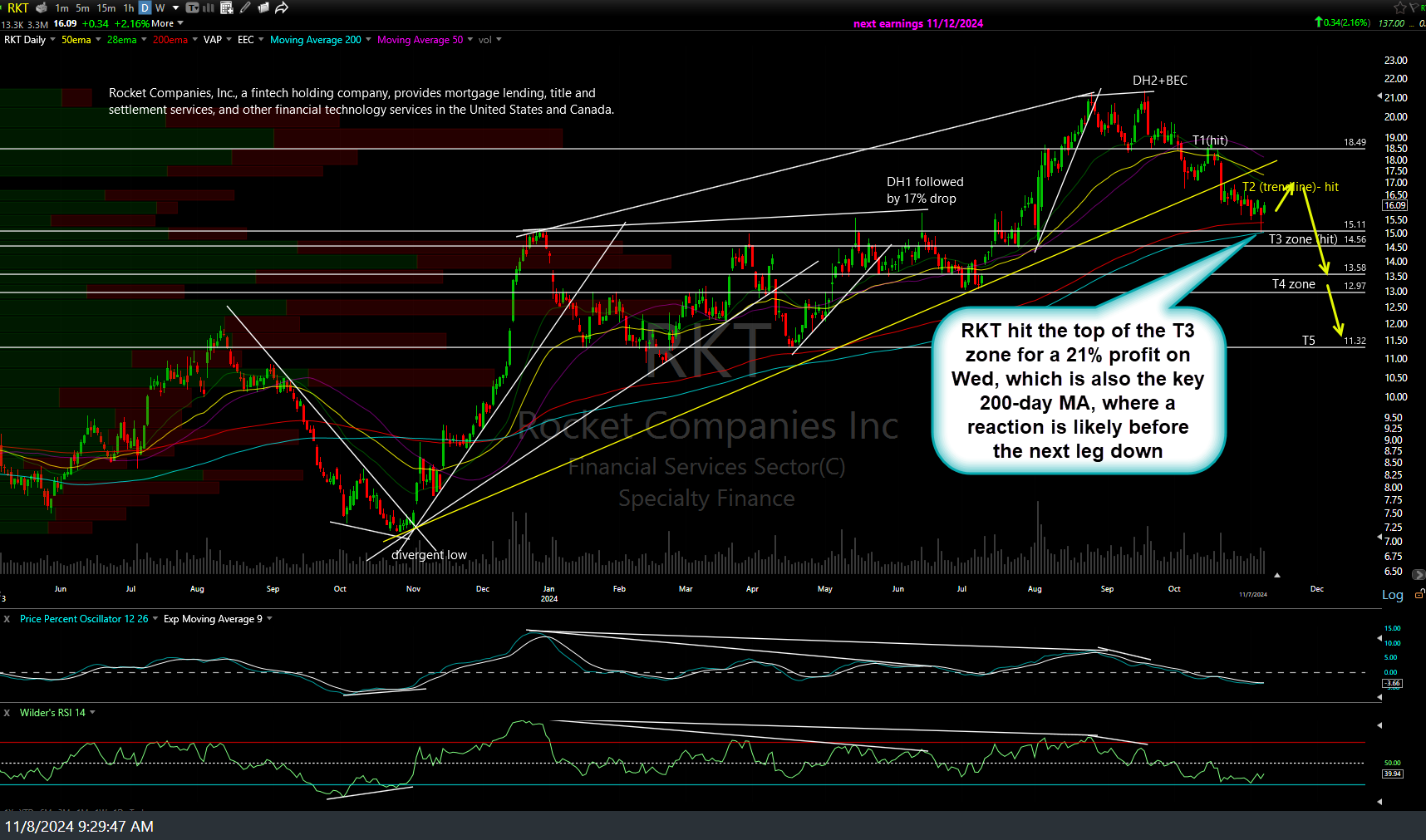

The RKT (Rocket Companies) short swing trade has hit the forth price target zone (T4 zone) for a 31% profit with the odds for a reaction elevated at this time. Consider booking partial or full profits and/or lowering stops if holding out for T5. Previous & updated daily charts below.

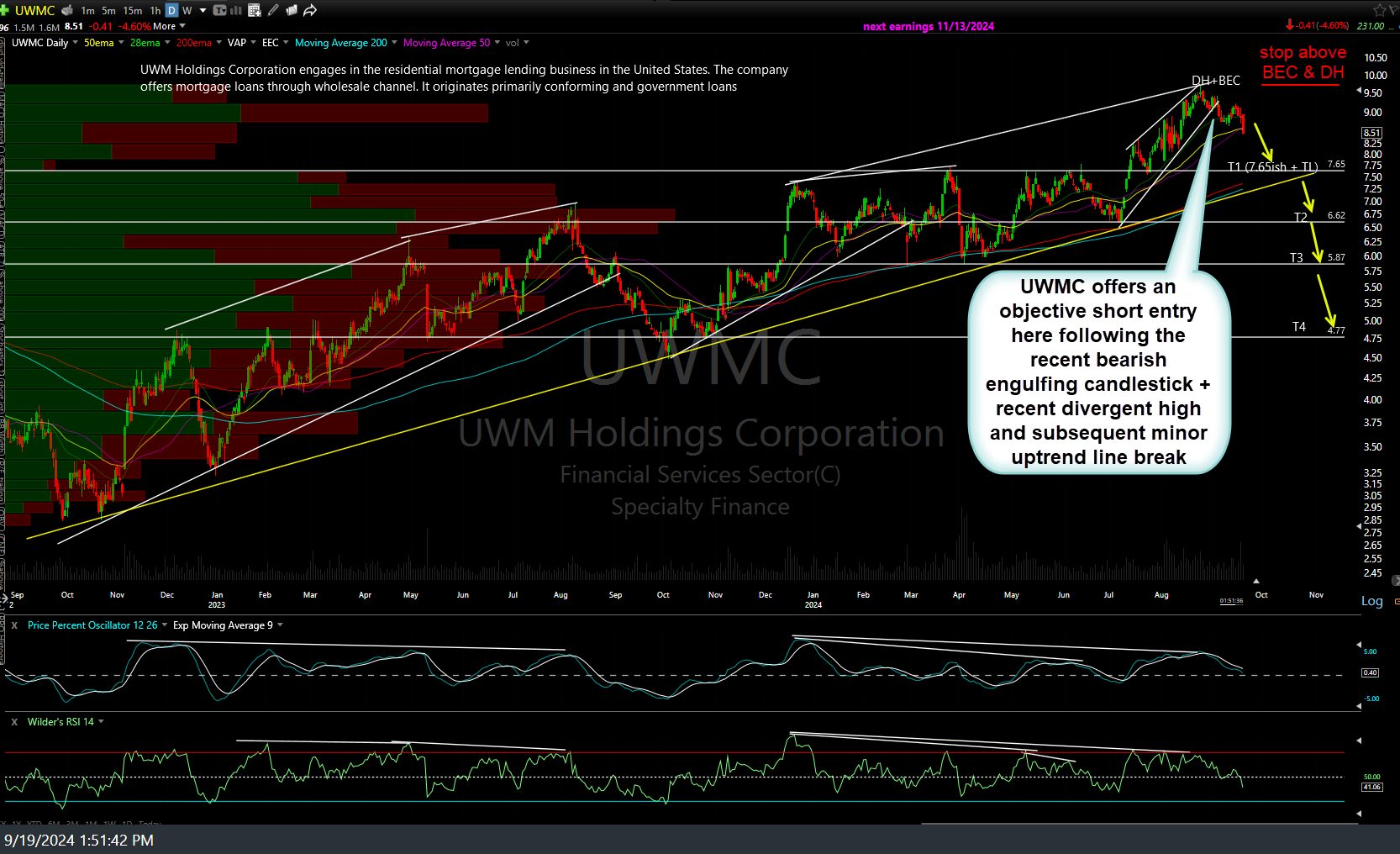

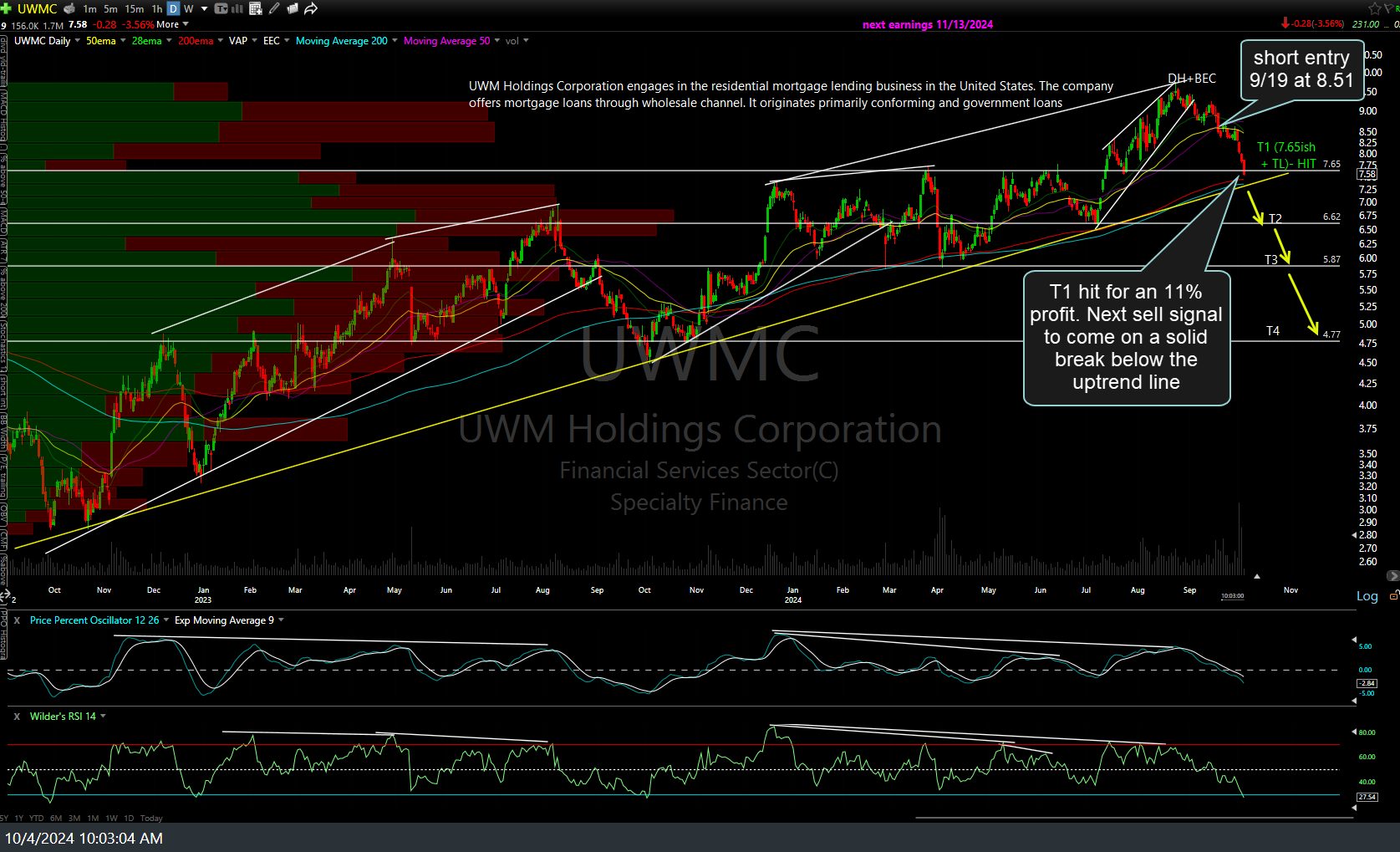

Likewise, the sister short swing trade also entered on Sept 19th, UWMC (UWM Holdings Corp) has just hit the third price target (T3) for a 30% profit with the odds for a reaction also elevated at this time.Consider booking partial or full profits and/or lowering stops if holding out for T4. Previous & updated daily charts below.

Not much else to update with the market trading flat most of the day although a few things worth noting:

- PYPL is currently approaching the 2nd price target

- /GC (gold futures) is still testing (holding support) the key uptrend line (highlighted in yesterday’s video). GDX also continues to consolidate on (test) that 36 price target/support

- /NG natural gas futures & UNG (nat gas ETN) continues to push up against & consolidate just below the price targets/resistance levels that were recently hit with the next buy signal to come on a solid break above