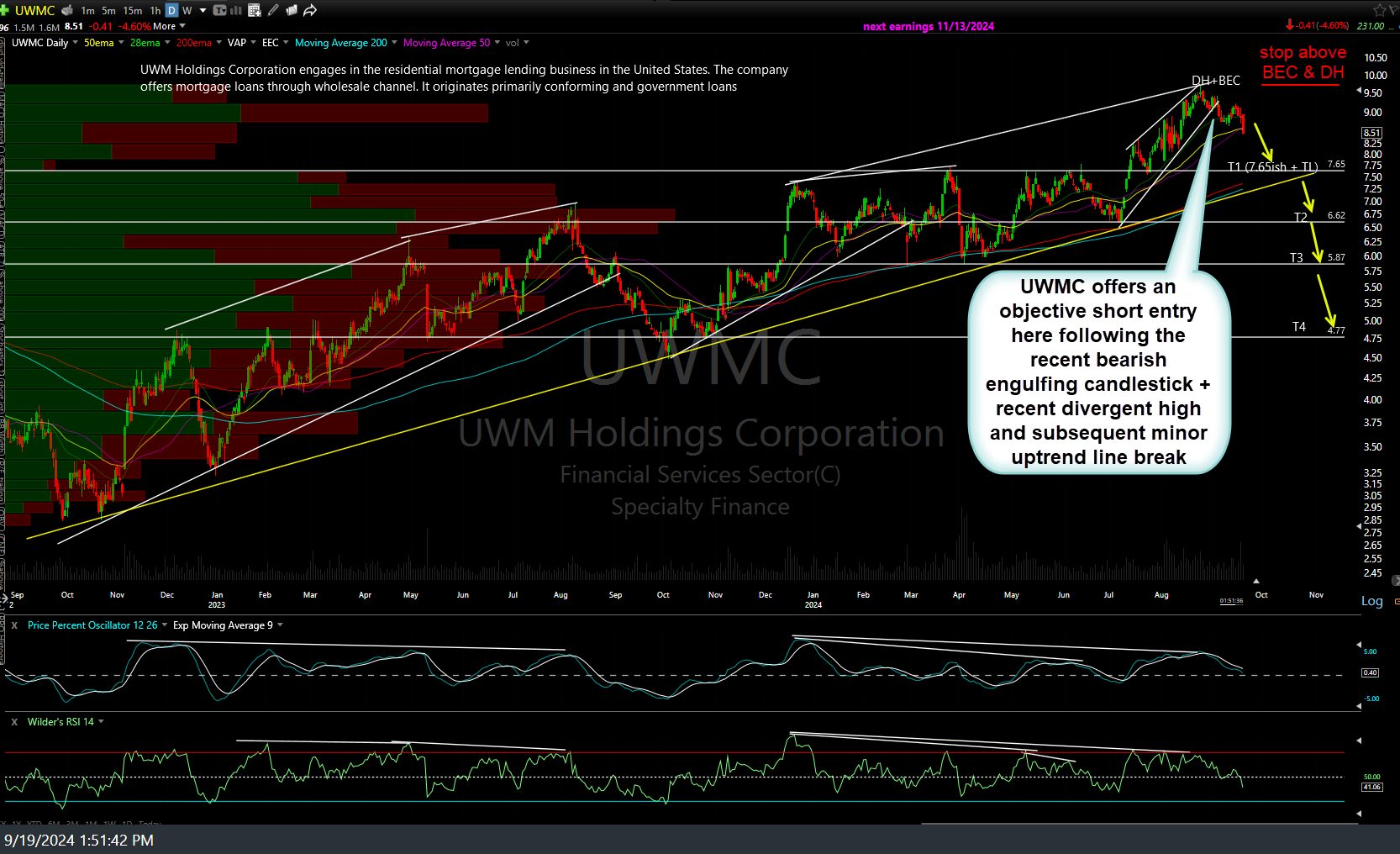

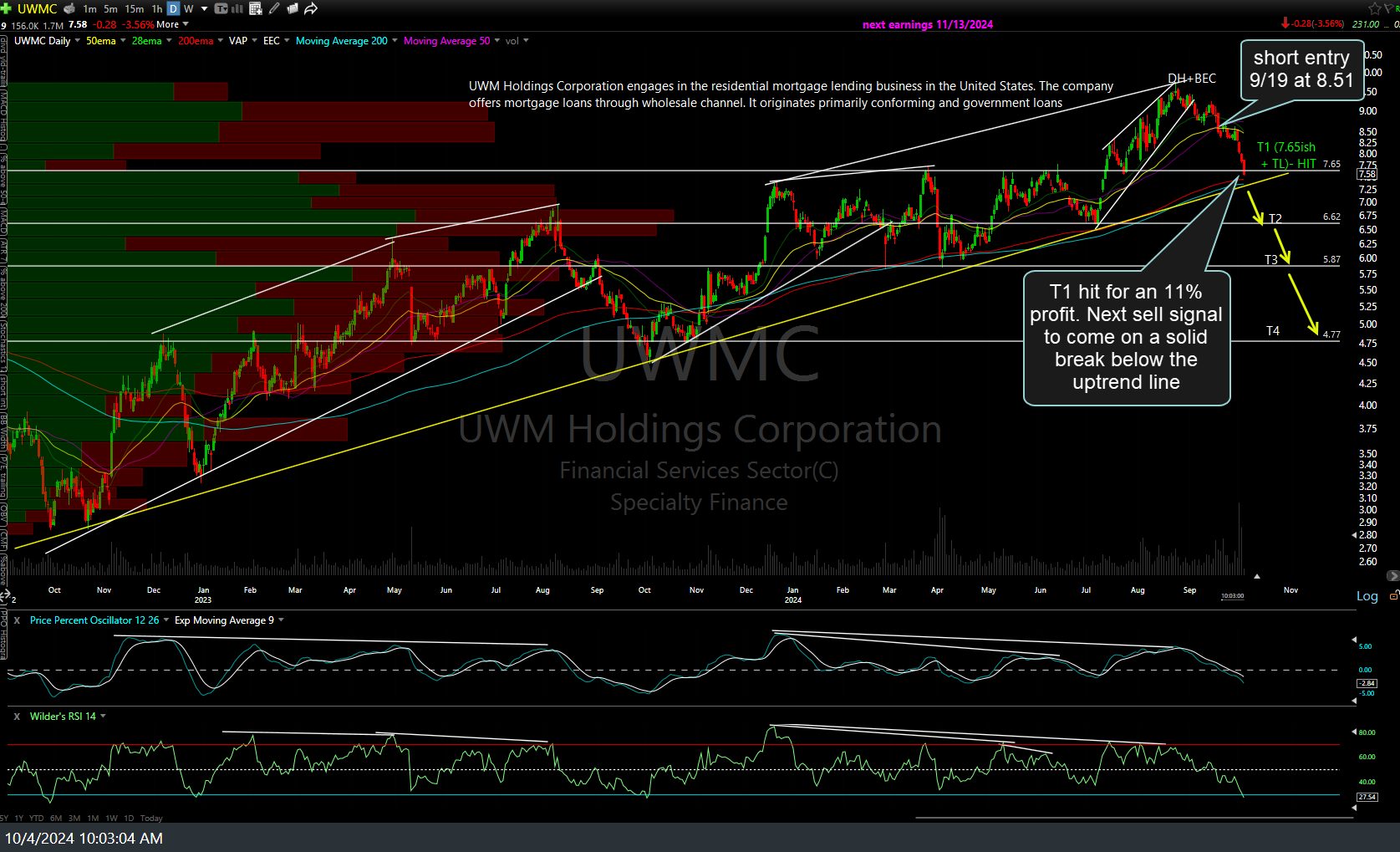

The UWMC (UWM Holdings Corp) swing trade has just hit the first price target (T1) for an 11% profit. Depending on your trading plan, consider booking partial or full profits and/or lowering stops if holding out for any or all of the additional targets Next sell signal to come on a solid break below the uptrend line. Previous & updated daily charts below.

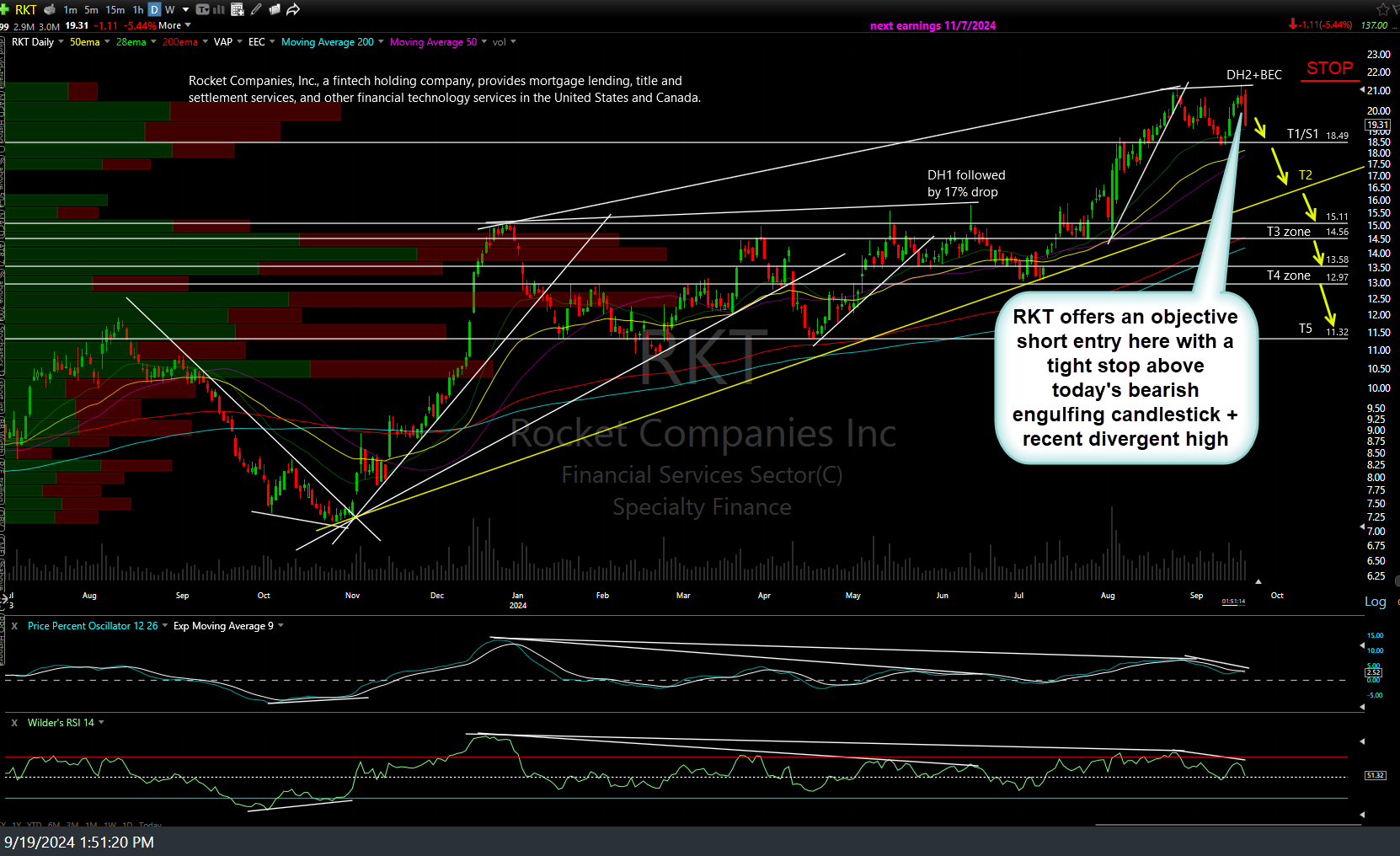

UWMC was posted along with two other related mortgage stocks with my preference to short all three for a more diversified bearish bet on the sector. The RKT (Rocket Companies Inc.) sister trade is currently approaching its second price target (primary uptrend line) with a gain of about 12% since the Sept 19th entry. Previous & updated daily charts below.

It’s far from mere coincidence that my bearish bet (active short trade) on long-term Treasury bonds (i.e.- a bet on rising yields), including today’s big drop in TLT (spike in yields) closely mirrors the drop in these mortgage related stocks & helps to illustrate the catch-22 that the Fed has boxed itself into: Keep juicing an already strong economy & stock market near all-time highs with a rate cutting cycle & you cause long-term rates to rise in anticipation of stronger economic growth & inflation.