The USO (1x non-leveraged crude ETN) Active Long Swing Trade has gapped above the top of the 60-minute falling wedge in the pre-market session although /CL needs a little more upside for a breakout above its comparable wedge pattern.

/CL (crude oil futures) still appears poised for a likely breakout above this bullish falling wedge & if so, will likely outperform the equity market in the coming days to weeks. As such, I am viewing a long on crude as an indirect hedge to my mild/starter short position on the Nasdaq 100.

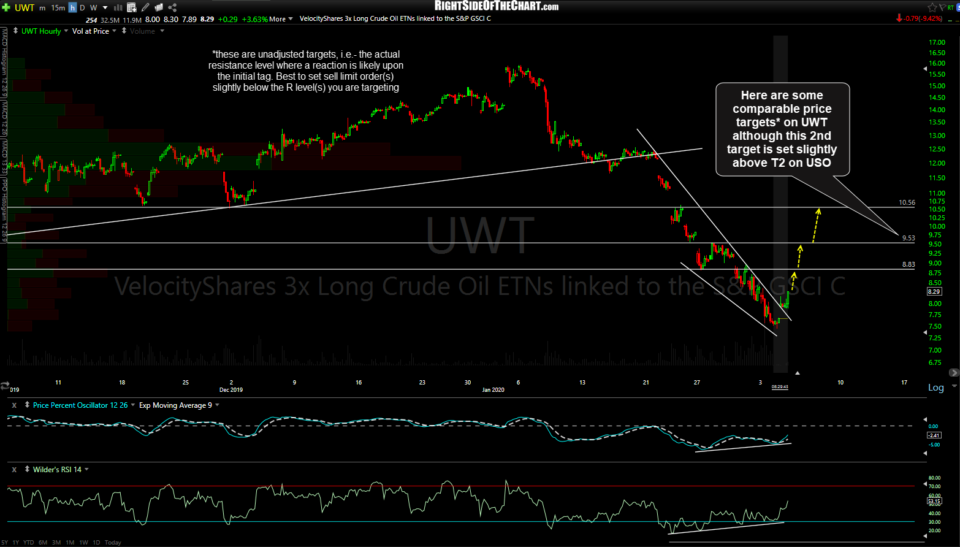

Here are some comparable price targets* on UWT (3x bullish crude ETN) although this 2nd target is set slightly above T2 on USO. 60-minute chart: