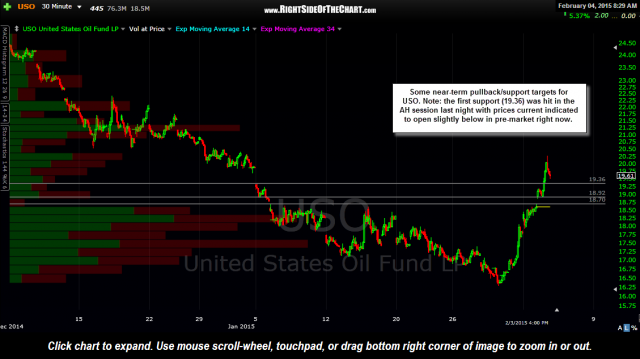

Here are a few near-term pullback targets for USO, along with my thoughts (as cut & pasted from a email reply from last night), along with a 30 minute chart of USO with those support levels marked.

Although I closed my SCO (2x short crude etf) just a few hours after taking it (for just under a 6% gain), I have not yet decided if & when to add back significant exposure to the energy sector at this time. Also note that USO is currently trading below where it closed yesterday (19.23 as I type), offering a better exit for those that may have also shorted crude as a pure play or hedge against any long positions in the energy sector.

Q: What is your target for SCO assuming that crude pulls back from here?

A: I was shooting for a backfill of that Jan 5th gap on USO and although we didn’t quite get there during the regular session, USO did reach it after the close today. I really had a strong preference to not go home short crude oil (or even with much long exposure to the energy stocks for that matter) so I fired off the SCO at 76.00 in AH. Also closed several of the energy trades from the site (was long all of them although I don’t always take every trade that I post). Kept a couple positions which I’m willing to ride out any initial pullback in crude, assuming that there is more to come.

I’d rather be very quick on the short side right now, just like I was on that GDX pullback a week or so ago, because the near-term trend is up plus crude was so flippin’ oversold that any pullbacks on this snap-back rally could get bought up very quickly by shorts trying to get out & wanna be longs/bottom catchers waiting to get in.

If you still have SCO, I’d follow both the USO & CL charts to determine entries & exits. First support/target is the bottom of that Jan 5th gap at 19.36 on USO, then around 18.92, then 18.70-18.60 (top of the recent trading range) by which point I would definitely close my short had I decided to hold it.