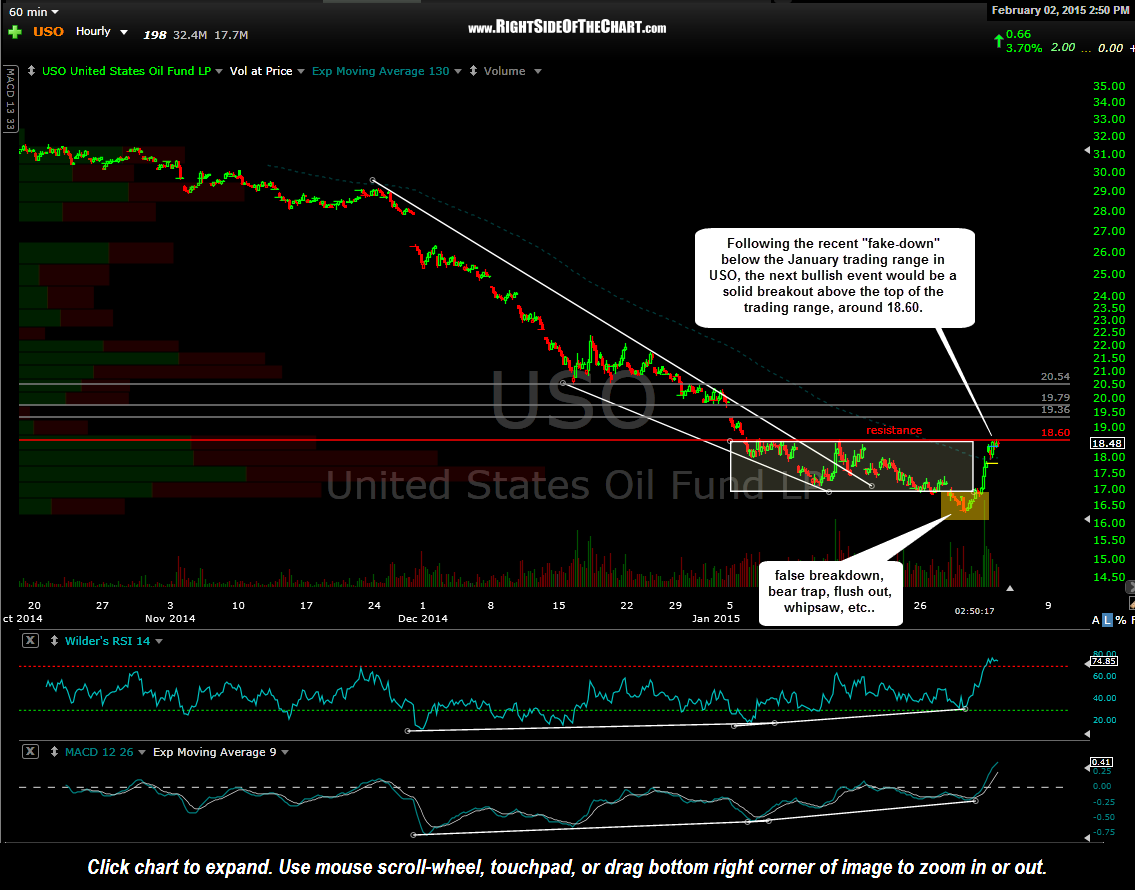

Following the recent “fake-down” below the January trading range in USO, the next bullish event would be a solid breakout above the top of the trading range, around 18.60. As is typically the case, the rally immediately following the failed break below the trading range was very impulsive (fast gains accompanied by high volume). This is usually the result of short-covering, both those who were already short plus the Johnny-come-lately’s that decided that shorting a breakdown on an already insanely oversold security with strong bullish divergences in place was a prudent decision, as well a long-side traders jumping in to both take advantage of the shorts’ precarious situation and those just waiting to trade an oversold bounce on crude.

Of course the battle is far from over yet. The top of the recent trading range (18.60ish) is resistance until proven otherwise. The rally in crude has stalled so far today at that level which is to be expected as the initial tag of resistance from below is often followed by either an initial pullback and/or a consolidation. In fact, a little pullback or sideways price action in USO would help to clear the very near-term overbought conditions, thereby providing some extra fuel for a sustained breakout and rally above the trading range and a move up to at least the 19.36 area which is the bottom of the Jan 5th gap and the first bounce target/overhead resistance level. All of the existing energy stock trade ideas (RIG, SFY, NOV, QEP, SLB & EXXI) still look poised for a decent rally, again, assuming that the recent scenario on USO/crude oil continues to play out.