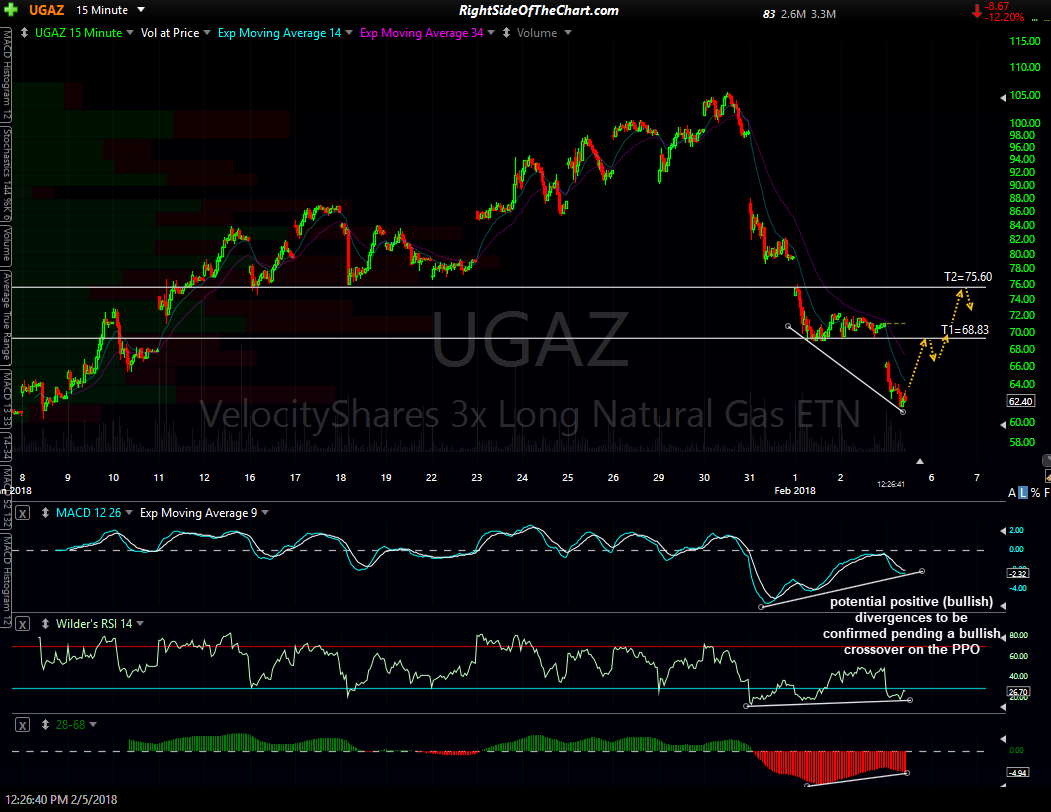

UGAZ (3x long natural gas ETN) offers an aggressive long entry here around the 62.40 level for a bounce trade up to either of these two price targets, T1 at 68.83 & T2 at 75.60. The suggested stop (based on the final target) is any move below 59.60, which offers an attractive R/R of 4:1. As nat gas has been in free fall since the divergent high on the 60-minute chart on Jan 30th, this should be considered an aggressive, “catch-a-falling-knife” trade. Factoring in the 300% leverage as well as the inherent volatility of natural gas prices, the suggested beta-adjustment for this trade is 0.30 (i.e.- 30% of a typical swing trade position). Of course, one should pass if this type of trade does not mesh with their trading style, risk tolerance or objectives.

Natural gas futures (/NG) have now hit the 61.8% Fibonacci retracement of the rally off the Jan 5th reaction low with potential bullish divergences forming on this 60-minute time frame & appear poised for a 6½% rally up to the 2.905 resistance level.

- NG 60-min Feb 5th

- NG 60-min 2 Feb 5th