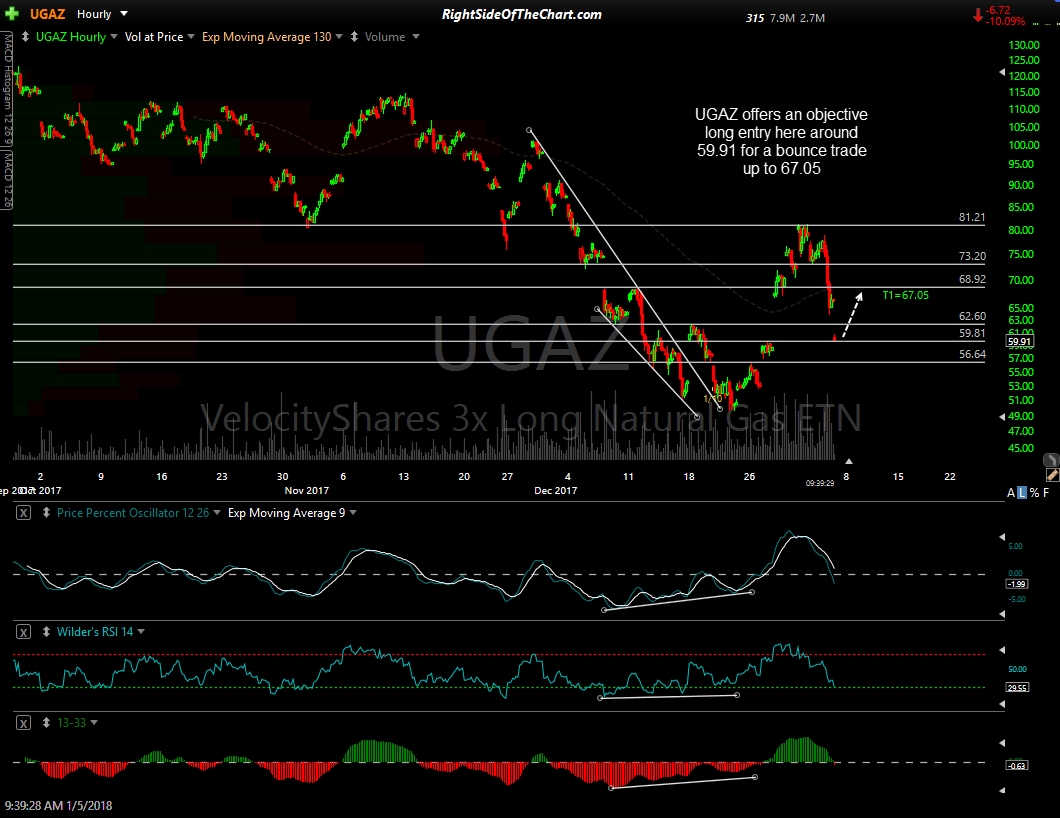

UGAZ (3x bullish natural gas ETN) offers an objective long entry here around 59.91 for a bounce trade up to 67.05 (the sole price target at this time). The suggested stop is any move below 58.20 with a beta-adjusted position size of 0.35*. Additional details on this trade are provided in the Swing Trade Setups video posted earlier today.

*The beta-adjustment of 0.35 would be for a swing trade that might last for more than one day. Those positioning for a quick bounce off the current support level for a daytrade only might consider a beta-adjusted position of 1.0 (i.e.- a full or typical position size) as that would not entail any overnight risk, i.e.- the risk of a large gap against your position, should nat gas futures fall sharply in the overnight/early morning trading session.