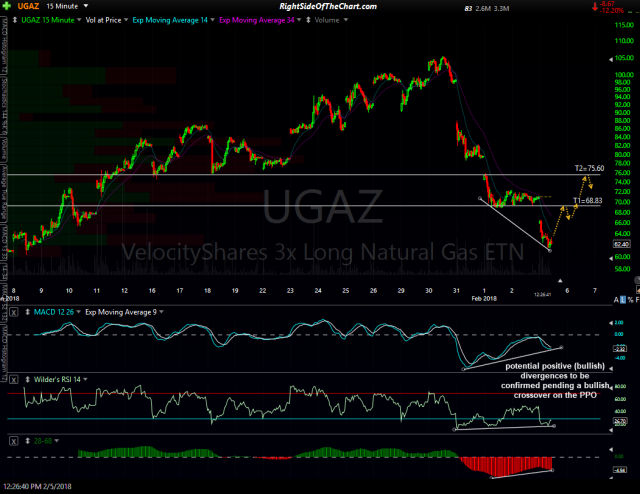

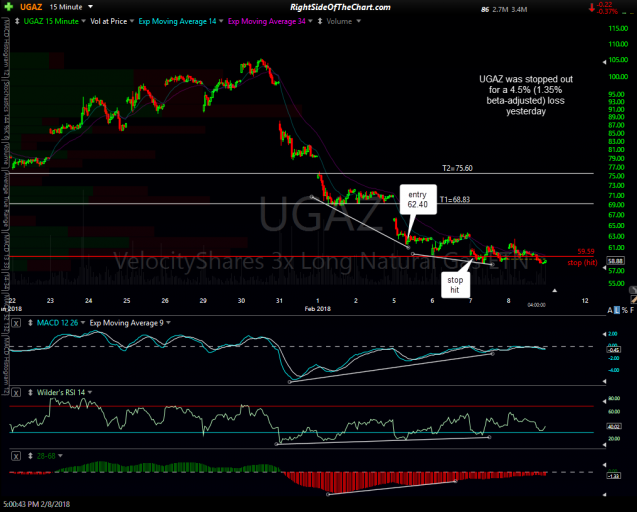

The UGAZ (3x Long Natural Gas ETN) swing trade was stopped out yesterday for a 4.5% loss or a 1.35% effective loss as the suggested beta-adjusted position size was only 0.3%, or 3/10ths of a typical position size. UGAZ will now be moved to the Completed Trades archives. Previous & updated 15-minute charts:

- UGAZ 15-min Feb 5th

- UGAZ 15-min Feb 8th

The D (Dominion Resources Inc) trade hit the suggested stop of 73.39 on Tuesday for a loss of 2.65% or a beta-adjusted loss of 3.18 as the beta-adjusted position size for this trade was 1.2 (20% above a typical position size). D will now be moved to the Completed Trades archives.

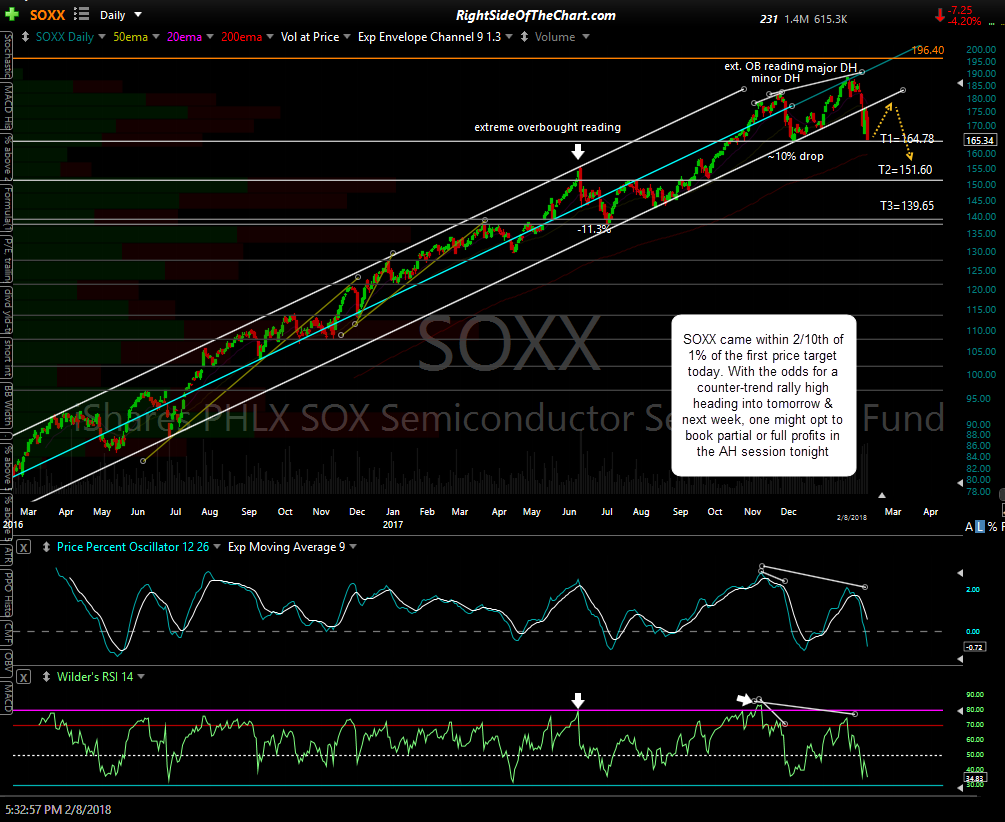

On a somewhat related note, the SOXX active short trade closed at 165.20 today, just 2/10ths of 1% above the first price target of 164.78. With a decent chance of the market mounting a substantial rally, should those potential 60-minute positive divergences on the major indexes be confirmed tomorrow via bullish crossovers on the PPO & MACD and the markets closing green, those that were planning to book partial or full profits on the SOXX short or SOXS long might opt to do so in the after-hours trading session tonight.