Another slow day in the market as it continues to consolidate after the sharp rally off the Feb 9th lows. This is perfectly normal & appears to be healthy consolidation which has worked off the near-term overbought conditions & could clear the way for the next advance in the broad market. Should my scenario of another thrust higher soon change, I will communicate my thought asap.

I’ve mentioned a few times over the past week that the recent UGAZ (3x bullish natural gas ETN) trade idea barely had the stop clipped last Friday & that as with all official trade ideas, an official update & post would soon be made in order to re-assign all related posts on that trade to the Complete Trades category where they will be archived indefinitely for future reference.

- UGAZ 15-min Feb 14th

- UGAZ 15-min Feb 23rd

The suggested stop on UGAZ of any move below 51.60 (i.e.- any print of 51.59) which was hit last Friday with the ETN reversing just 4 cents below that level at 51.55 before rallying & so far coming within 8 cents of the first price target of 58.18. The total loss for the trade was 5.5% with a beta-adjusted loss of only 1.38% as due to the 300% leverage plus the volatile nature of nat gas prices, the suggested beta-adjusted position size for this trade was only 0.25 or ¼th of a typical position size. UGAZ is on watch for another potential entry but as of now, much like the broad market, nat gas has been trading mostly sideways for the past week so I’d prefer to stand aside & watch how the charts develop at least into early next week.

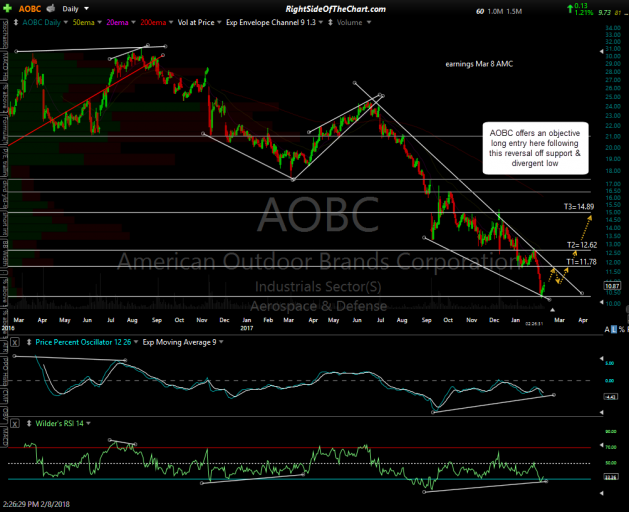

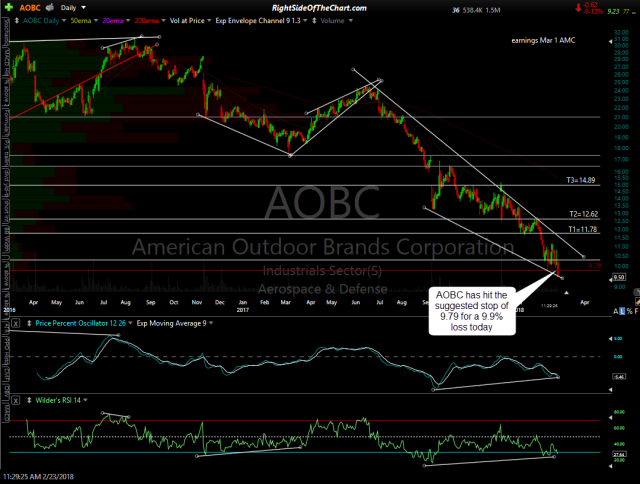

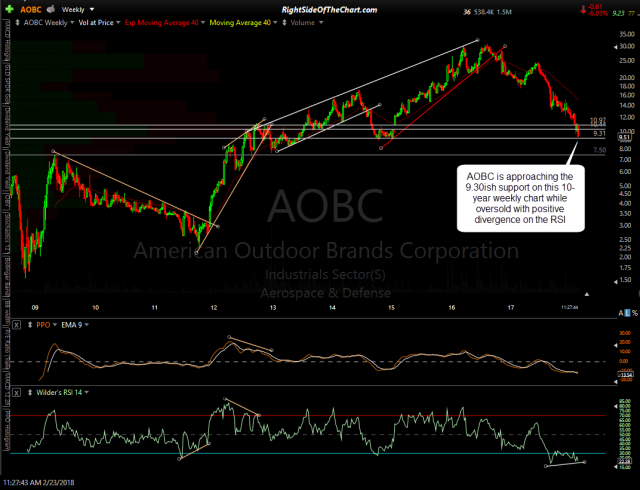

The AOBC (American Outdoor Brands Corp) has exceeded the suggested stop of 9.79 today for a 9.9% loss as the stock continues to come under selling pressure in the wake of the recent school shooting, most likely the result of institutional selling under pressure or concerns about funds holding this position at this time due to public opinion. This stock is trading just above long-term support (see weekly chart) below & is scheduled to report earnings on March 1st after the market close. AOBC will now be moved to the Completed Trades category although I will be glad to provide updates on this or any other trade idea upon request.

- AOBC daily Feb 8th

- AOBC daily Feb 23rd

- AOBC weekly Feb 23rd