Remember, the initial knee-jerk reaction following a key FOMC meeting such as today’s meeting, is very often faded with a nearly equal reaction in the opposite direction. It also not unusual to see the market’s subsequent rip or dip after that faded as well. I like to wait until at least the following day before trying to get a read on where the market might be headed next but as we head into the close, I will share that it still appears to me that the market will ultimately move below these recent sideways trading ranges over the last couple of months & with as long as we’ve been moving sideways, I strongly suspect that we will have a definitive breakout, one way or the other, by the end of next week if not sooner.

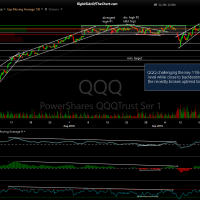

- QQQ 60-minute 2 Sept 21st

- SPY 60-minute 2 Sept 21st

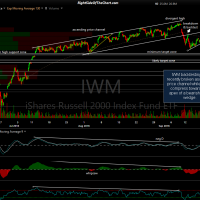

- IWM 60-minute 2 Sept 21st

Here’s a quick look at the 60-minute charts (screenshots taken shortly before the closing bell). QQQ challenging the key 118ish level while close to backtesting the recently broken uptrend line, the initial reaction to the FOMC meeting popped the SPY above this triangle pattern although it still has a thick resistance zone overhead to contend with and IWM is backtesting the recently broken ascending price channel while prices compress towards the apex of a bearish rising wedge.