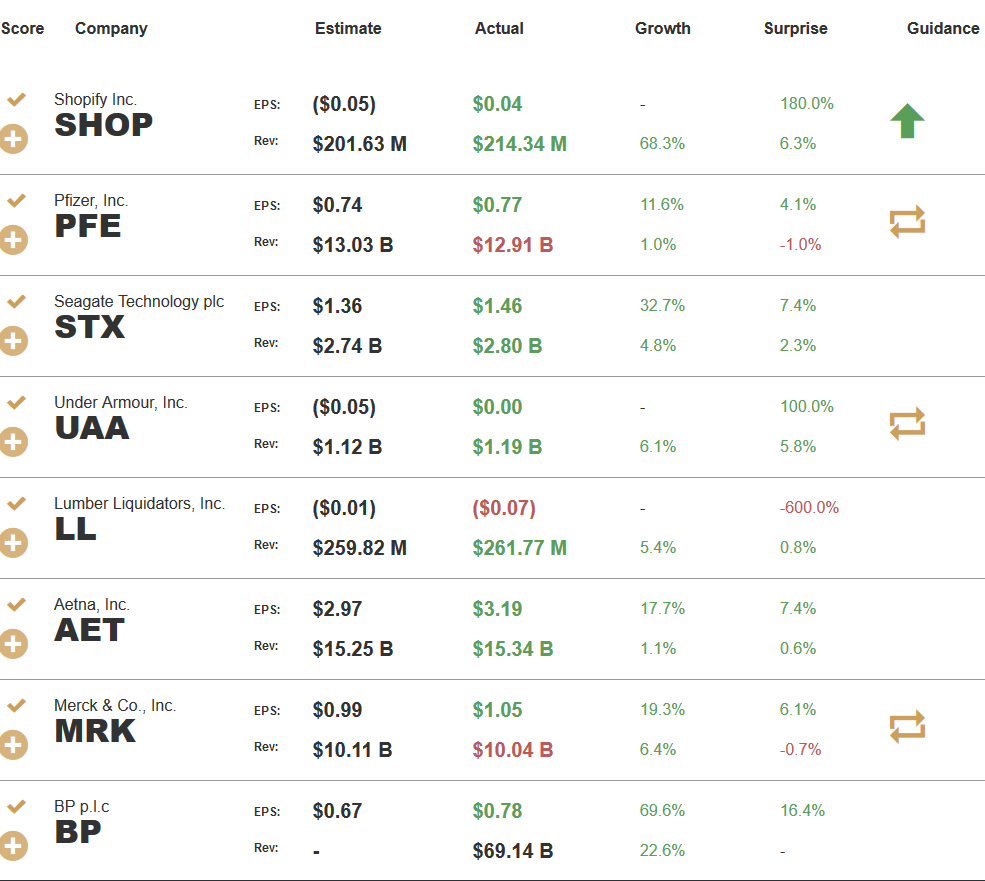

The following stocks reported earnings before the market open today & as such, the risk of being caught on the wrong side of an earnings-induced gap is now out of the way for the next 3 months.

The charts below are the daily charts of some of the stocks that standout as potential swing trading opportunities. SHOP (Shopify Inc) closed down 4.5% after reporting earnings before the open today, once again kissing the primary uptrend line which it’s been riding on for the last few weeks. SHOP is on watch for a break below for a potential swing short trade.

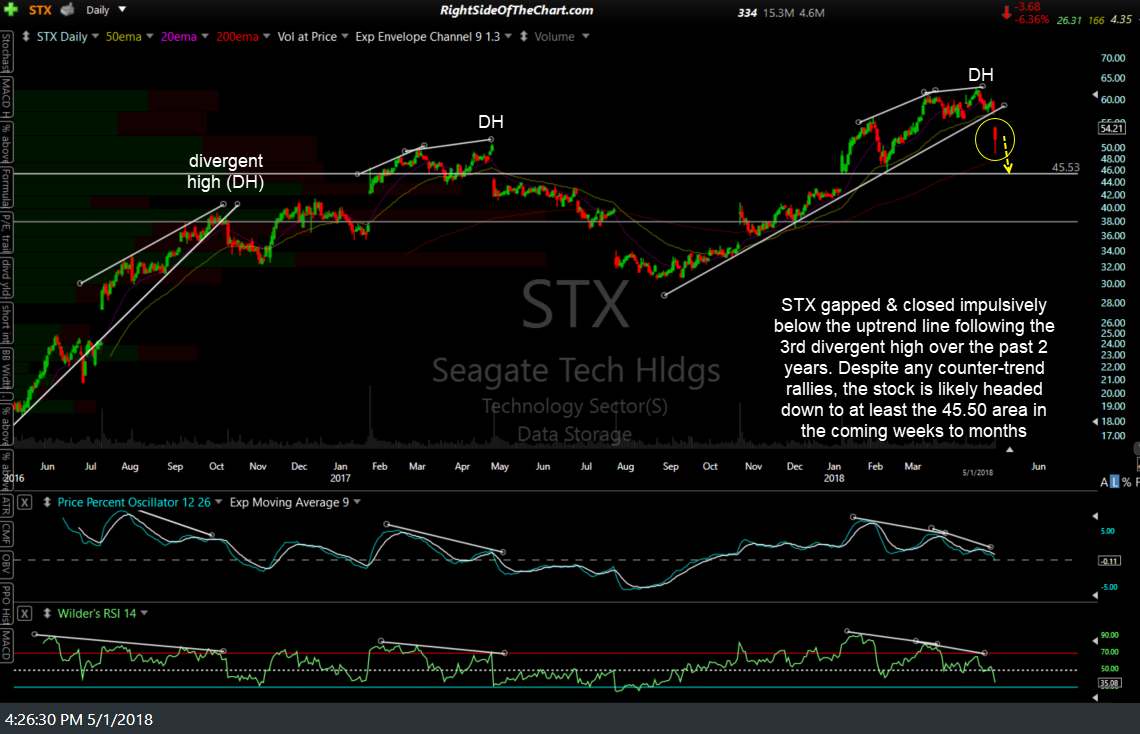

STX (Seagate Technology) gapped & closed impulsively below the uptrend line following the 3rd divergent high over the past 2 years. Despite any counter-trend rallies, the stock is likely headed down to at least the 45.50 area in the coming weeks to months.

UAA (Under Armour Inc) closed up just below the 18.36ish resistance level & remains within a tight sideways range since mid-Feb. Sharp moves usually follow breakouts above or below such consolidation periods & this one could go either way, with a long entry on an impulsive break above 18.40 or a short entry on an impulsive break below 15.85.

AET (Aetna Inc) reported before the open today with the stock backtesting the recently broken trendline from below as the momentum indicators start to roll over. Watching additional selling from here, ideally impulsive selling as well as a bearish crossover on the PPO.

BP (BP PLC) reported earnings today & as with most energy stocks, has been rallying in lock-step with crude oil, which appears poised for a correction along with BP. BP sell signal to come on a break below this steep uptrend line which appears imminent as the PPO starts to rollover at high levels while the RSI is coming off overbought readings.