/CT (cotton futures) offers an objective long entry on this breakout & successful backtest of this 60-minute bullish falling wedge pattern. Price targets* denoted at arrow breaks. *actual resistance levels where reactions are likely, best to set sell limit order(s) just below one’s preferred target(s).

The longer-term case for a long on cotton can also be made on this daily chart as cotton has fallen to the 85ish support level with strong positive divergences in place between price & the momentum indicators.

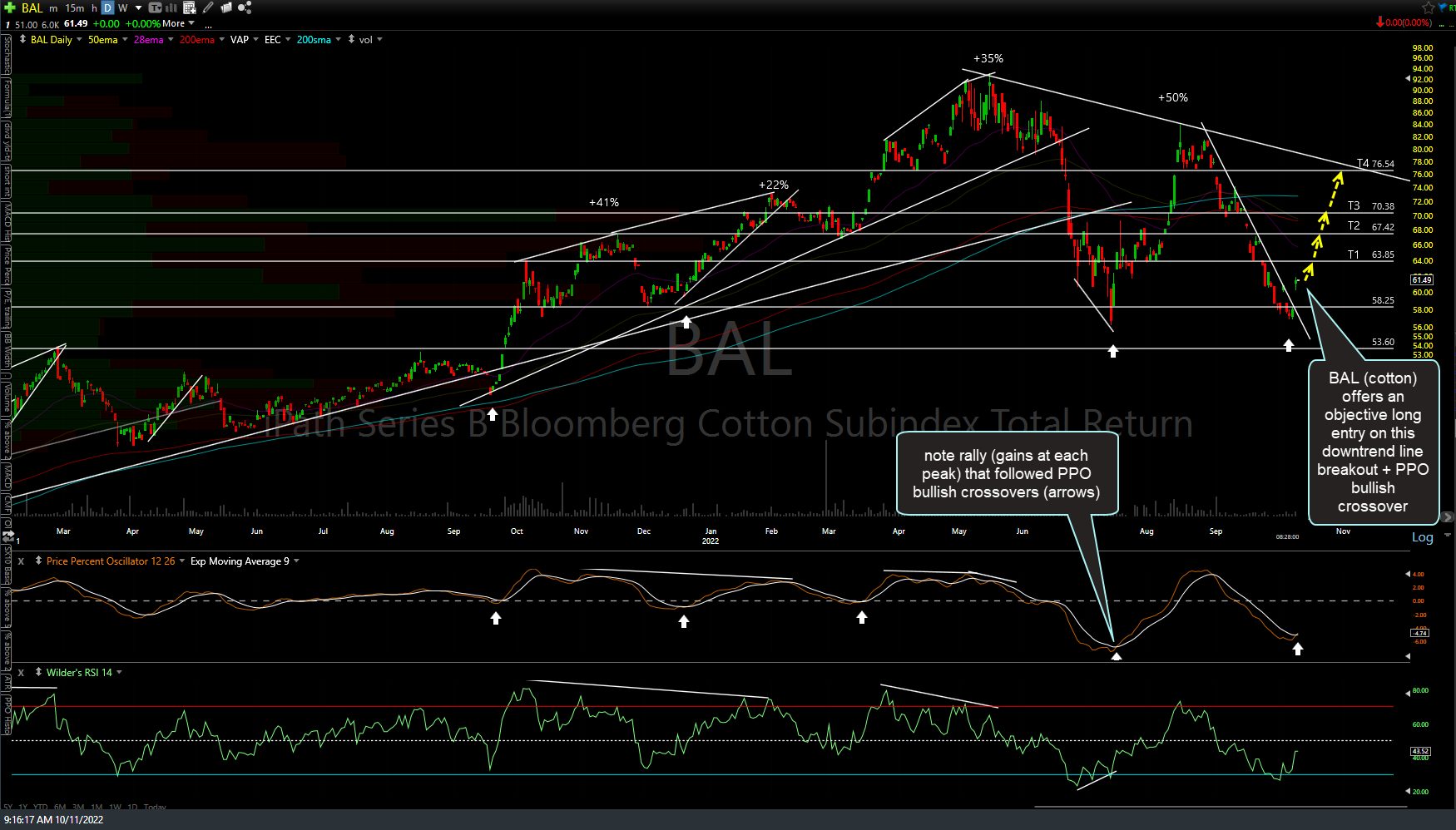

For those that prefer exchanged traded products over futures, BAL (cotton ETN) also offers an objective long entry on this downtrend line breakout + PPO bullish crossover. Note the rallies that followed previous bullish crossovers over the past year with rallies ranging from 22% to 50%. Of course, past performance is no guarantee of future returns. ;-)