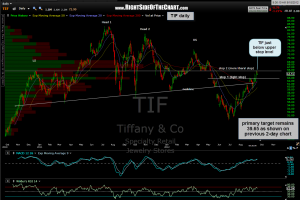

the TIF active short has exceeded the first (tight) stop level and is currently just below the 2nd, more liberal suggested stop. as i continue to prefer wide stops lately, i pulled my original tight stop and am still short TIF but won’t allow it much room above the stop 2 level. from entry, this trade is down 6.5%, still offering an excellent R/R from the original entry considering the primary target of 39.65. TIF could also provide an objective add-on or new entry short here with a tight stop above that level which would offer a tremendous R/R is the downside target is hit (which is still very likely IMO) and as such, i will add this to the short setups category. updated daily chart shown.

the TIF active short has exceeded the first (tight) stop level and is currently just below the 2nd, more liberal suggested stop. as i continue to prefer wide stops lately, i pulled my original tight stop and am still short TIF but won’t allow it much room above the stop 2 level. from entry, this trade is down 6.5%, still offering an excellent R/R from the original entry considering the primary target of 39.65. TIF could also provide an objective add-on or new entry short here with a tight stop above that level which would offer a tremendous R/R is the downside target is hit (which is still very likely IMO) and as such, i will add this to the short setups category. updated daily chart shown.