seems that it’s the BOJ’s turn to turn up the heat in the “race to the bottom” (currency devaluation wars).

News Alert from The Wall Street Journal The Bank of Japan took surprisingly strong steps to further ease its monetary policy following similar steps by the Federal Reserve, as it tries to tackle entrenched deflation, an export-sapping strong yen, and the impact of slowing global growth. The central bank's policy board decided at the end of a two-day meeting to increase the size of its asset purchase program—the main tool for monetary easing amid near-zero interest rates—to ¥80 trillion ($1.01 trillion) from ¥70 trillion. The dollar rose quickly against the yen following the announcement, to ¥79.02 from ¥78.69. the full article can be read here. (note: if the article is truncated by a subscriber log-in request, just cut & paste the title into search engine, search it, then click the first link to view full article).

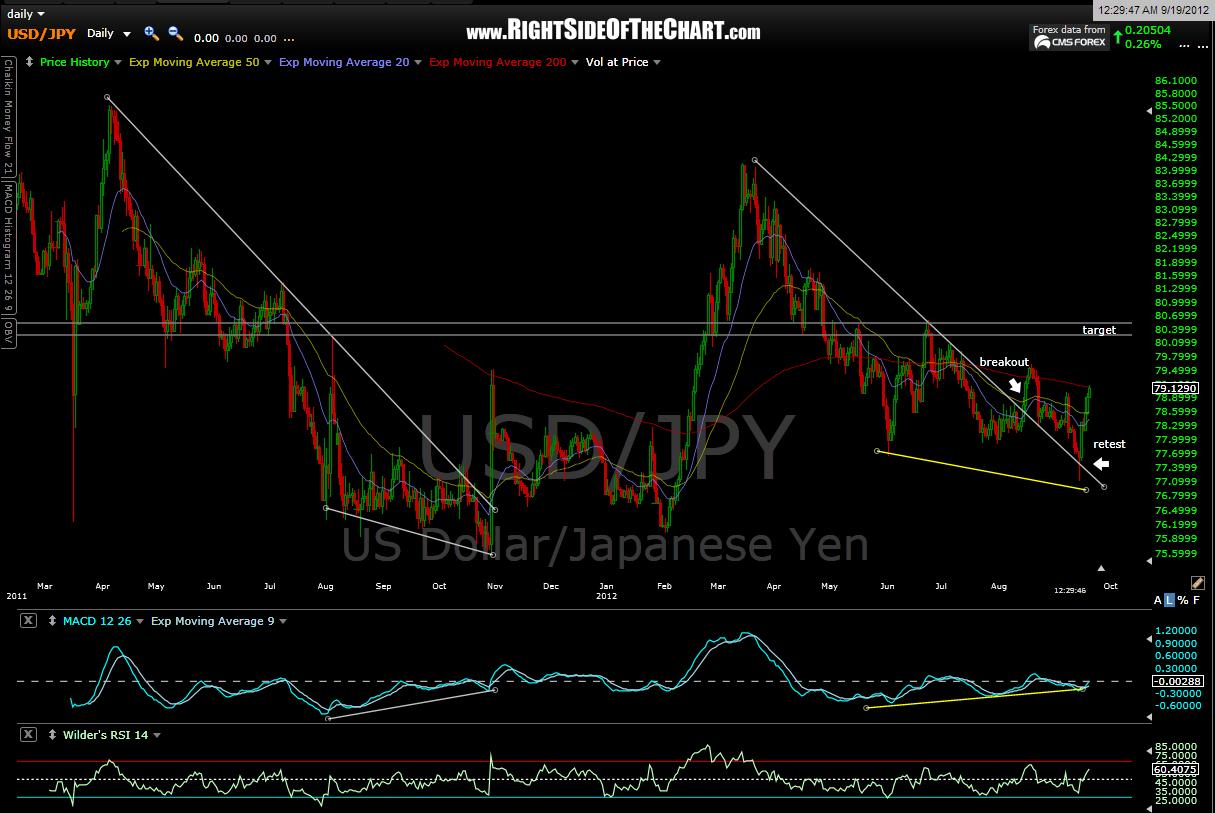

i still believe the $USD is setting up for a sharp bounce and this should help give it some tailwinds (until Burn-anke comes up with the next grand printing scheme). $USD/JPY daily chart below: