Over the years I’ve developed a fairly good knack of knowing when to actively engage the markets & when to step aside as to avoid getting ground up (i.e.- giving back profits) during periods of choppy, unpredictable price action. Although by no means perfect, I have often been able to identify ahead of time when the market was likely to begin trading in one of those difficult-to-trade, sideways trading ranges & as such, avoid or at least minimize giving back all or most of my profits accumulated during the previous rally or correction. Unfortunately, that has not been the case over the last several months which have been marked by the lowest success rate of trades on RSOTC since the inception of the site back in January 2012.

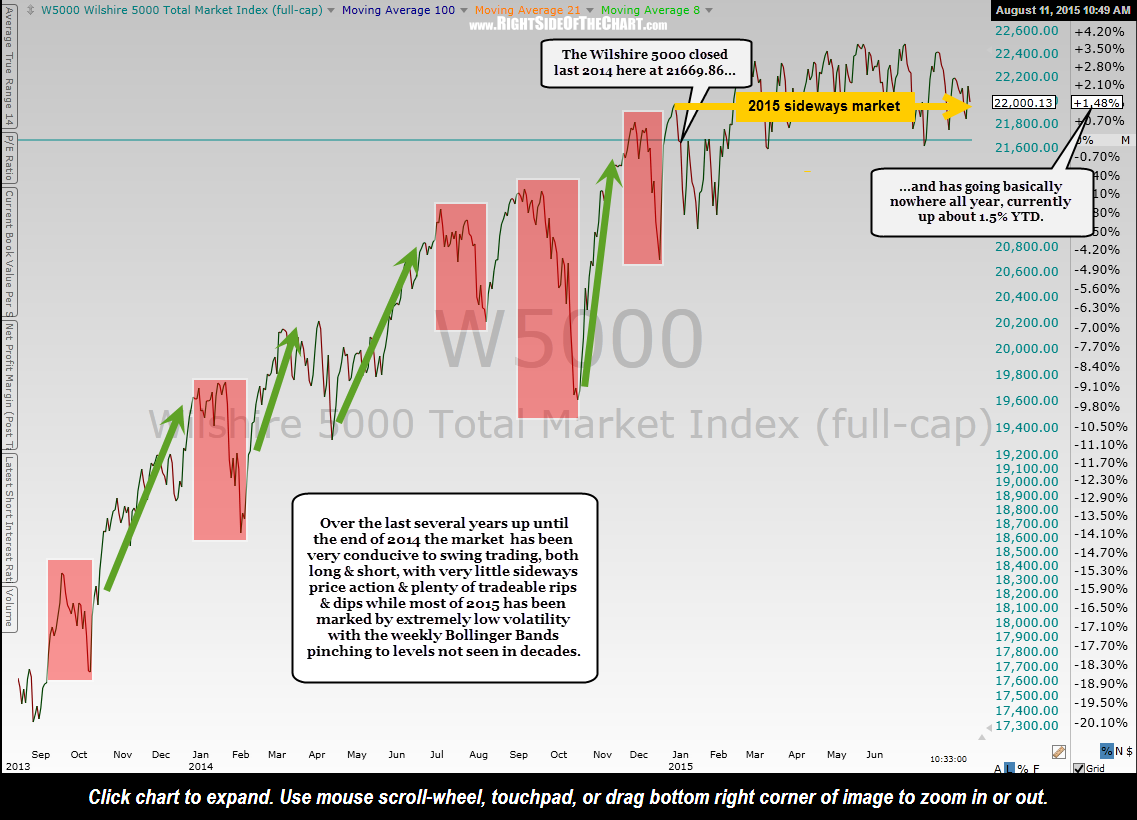

While I have, for the most part, kept position sizing on the lighter side in recent months and have definitely taken (and posted on the site) considerably fewer trades than normal, looking back, I should have reduced my trading activity to near zero. Of course hindsight is 20/20 but the take-away from this, at least for me, is to continue to strive to identify periods when the market is likely to chop around in a difficult to trade range such as we’ve experienced for nearly all of 2015 in order to side-step it while waiting patiently for right time to actively re-engage the market or any stand-out trading opportunities.

One of the early signs (again, looking back in hindsight) that should have been a yellow flag was the number & frequency of failed breakouts & breakdowns, both on the broad stock indices as well as numerous individual stocks. In other words, when all of a sudden it appears that technical analysis has suddenly stopped working, that’s usually a cue to step back and either take some time away from trading or, at the very least, become much more selective on the breakouts or trades that you do take.

For me, trading has always been a cycle of periods of gains followed by periods of drawdowns (losses). As a rookie trader, the drawdown periods would often match or even exceed the preceding winning streak (which often led to overconfidence). The overconfidence following a winning streak would then lead to two of the worst habits a trader can allow to develop; over-trading & over-leveraging.

Over-trading is succumbing to the urge to continually be engaged in the markets, despite how conducive to trading (or more specifically, your own unique style of trading) the market is at the time. It can be very hard to determine when to reduce your trading frequency and/or position sizing but as mentioned above, one of the first clues is when you notice an marked increase in the number of false breakouts, whipsaw signals and/or trades stopped out for a loss or breakeven. Often, these cold streaks only last for a short while (weeks) but at times, such as we’ve seen so far in 2015, those streaks can last for many months.

Using too much leverage, or even just being fully invested (without leverage) during the wrong time is another pitfall often experienced by rookie traders & even experienced traders are not immune to being caught on the wrong side of the market while aggressively positioned. Leverage can greatly enhance your returns but that power certainly cuts both ways. As with over-trading, trading on leverage or being fully committed (in a cash account) can quickly erode previous profits during drawdown periods. Although at times I still get caught on the wrong side of a trade or the market when leveraged, years ago I noticed that when my confidence starts to rise after an extended profitable run, that’s exactly when I need to either start reducing (or at least not increase) my exposure to the market. This means becoming more selective on adding any new positions, booking profits or tightening stops on existing positions, and/or hedging my portfolio (which is an acceptable reason for using leverage, as long as the hedges/ new positions have a high probability of offsetting and losses/giveback on the existing positions).

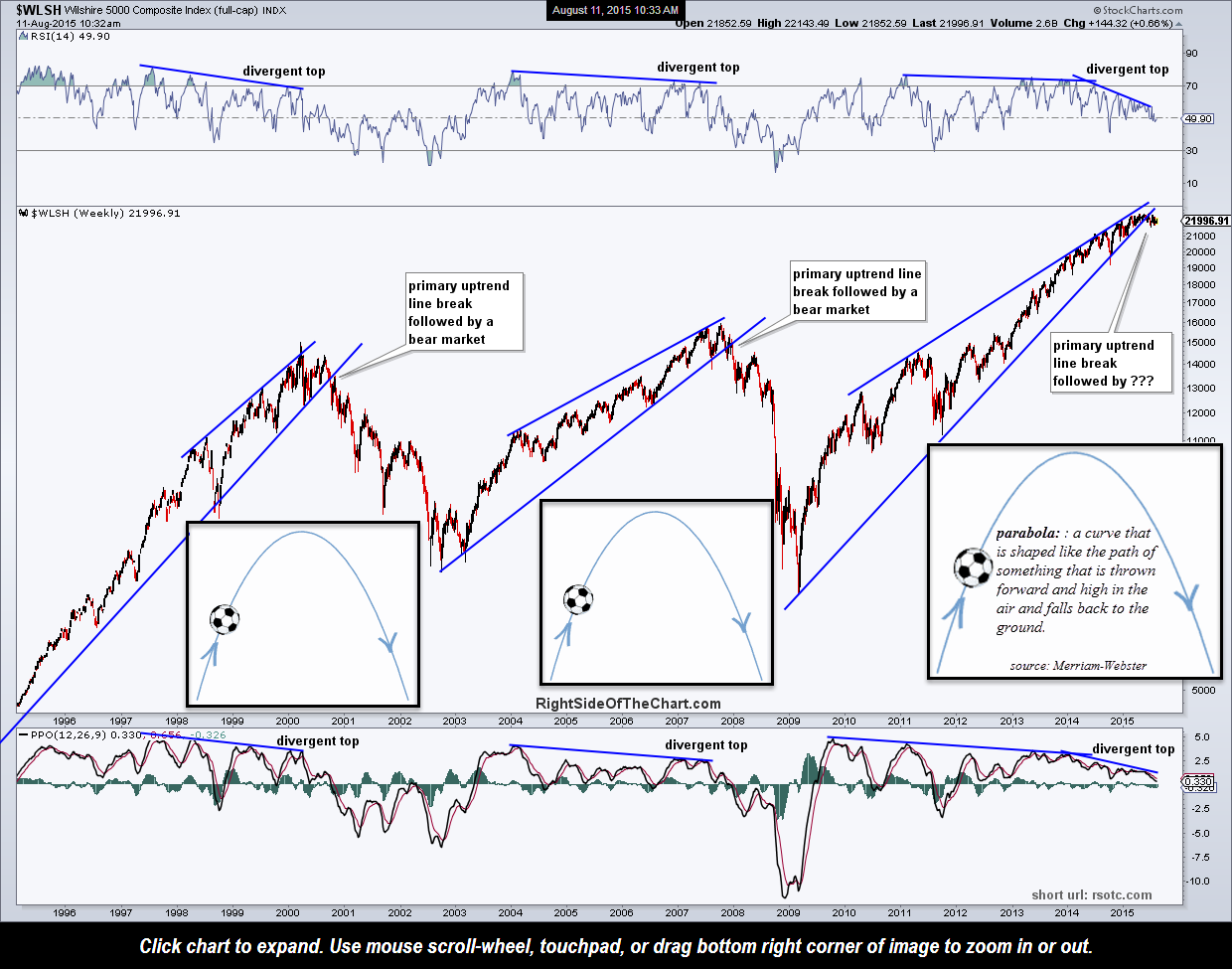

If there’s a silver lining to the recent futility of attempting to profit from a nearly impossible to trade market it would be that my biggest winning streaks have always come on the heels of such frustrating, unprofitable trading periods. Markets don’t trend in such tight trading ranges forever. In fact, the Bollinger Bands on the weekly chart of the Wilshire 5000 Composite (Full Cap) Index are currently pinched to the tightest levels in decades. Typically, such periods of extreme contraction in price swings are followed by sharp, often explosive uni-directional (up or down) moves once prices break out of that range.

I mentioned the Wilshire 5000 because it is the most representative US stock index, essentially aiming to tracking all publicly traded US stocks (excluding Bulletin Board/Penny Stocks), unlike the S&P500 (large-cap only) or Nasdaq 100 (tech heavy, also excluding certain key sectors of the economy). Based on not only the extended duration of the existing trading range but also recent technical breakdowns many of the major indexes, such as Wilshire 5000 in this 20-year weekly chart above, as well as market leading stocks (AAPL) and sectors (biotech, semiconductors, tranports, etc…), it still appears that the odds of a major correction (10%+ drop, if not a bear market (20%+ drop) will occur or at least be well underway by year end.

If, by chance, this trading range resolves to the upside and the technical outlook begins to morph from bearish to bullish, then I will do my best to adapt as the charts dictate. Although I still believe that the next 10% move in the market is much more likely to the downside before the next 10% higher, as always, long trade setups with clearly defined technical patterns and attractive R/R profiles will be posted along with the most promising short trading ideas, regardless of my own personal positions or market bias. I don’t take every trade idea posted on the site (although I take most of them) just as I take positions that may not be posted on the site for various reasons. Each trader or investor must decide what to trade, when to trade and most importantly, when to pass on a trade that doesn’t fit their trading style and risk tolerance. Congratulations to those who have successfully navigated this market so far in 2015 & for those who have not, may the wind be at your back for the remainder of the year.