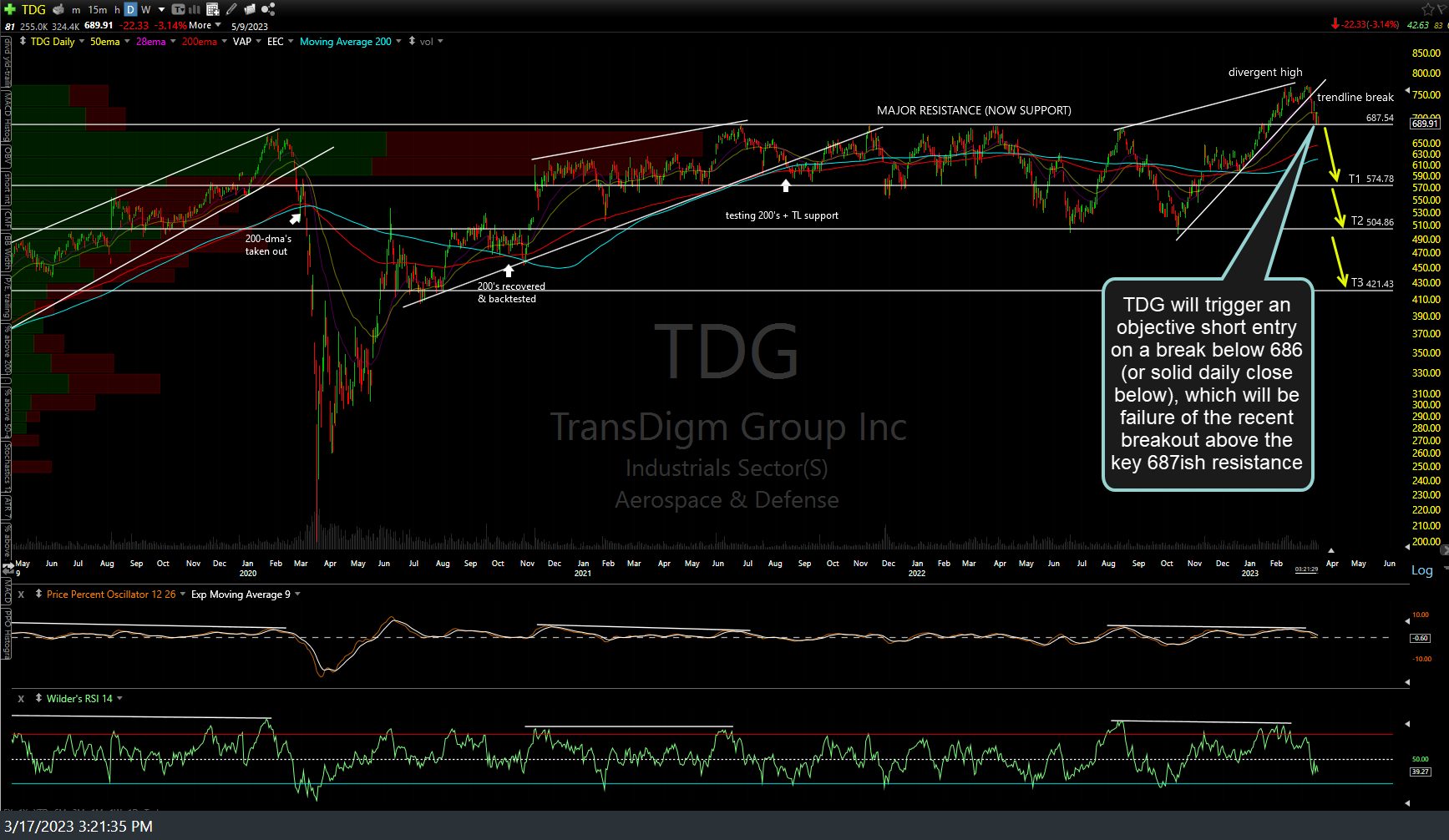

TDG (TransDigm Group Inc.) will trigger an objective short entry on a break below 686 (or solid daily close below*), which will be failure of the recent breakout above the key 687ish resistance following the recent divergent high & trendline breakdown. Daily chart below.

*The optional “solid daily close” below 686 would be a more conservative entry that would help minimize the chances of shorting a whipsaw dip below 686, should the stock recover back above that key level & rally from there. Additionally, we’re likely to see increased volatility in the stock market leading up to & after next Wednesday’s FOMC rate decision. While the potential advantage of waiting for a solid daily close below support is to minimize the chances of shorting a whipsaw, the downside is the potential to short at a much less favorable (lower) price, should the stock continue to fall sharply after the breakout fails.

Personally, I remain bearish on the industrials sector (to which TDG belongs, as a component of XLI) & plan to ride out any whipsaw should this trade setup trigger an entry on a break below 686, with a stop around the 745ish level as that would still provide an attractive R/R based on the downside (profit) potential & likelihood of this trade ultimately panning out, IMO. I also just covered my CAT short at T3 today with the intention of re-entering on either a bounce or a solid break below 210, depending on how the charts of the broad market, XLI, & CAT (also a component of XLI) look at the time.