TC (Thompson Creek Metals Co.) is one of the rare earth stocks shown from my rare earth stocks watchlist that was pasted onto the REMX chart posted yesterday. As mentioned in that post, that watchlist is comprised of 8 rare earth producers that trade on the US exchanges. Many of those stocks have been exploding higher recently after a vicious bear market that has taken many of these companies to penny stock status.

Despite percentage gains of double & even triple-digits in the last few weeks and even just the last few days, the charts remain constructive on most of these rare earth producers for both short-term & longer-term trades. However, I must reiterate that the individual stocks on my watchlist should be consider very aggressive trades with both high potential for risk AND loss. As always, only trade according to your own unique risk tolerance, trading/investing style and objectives.

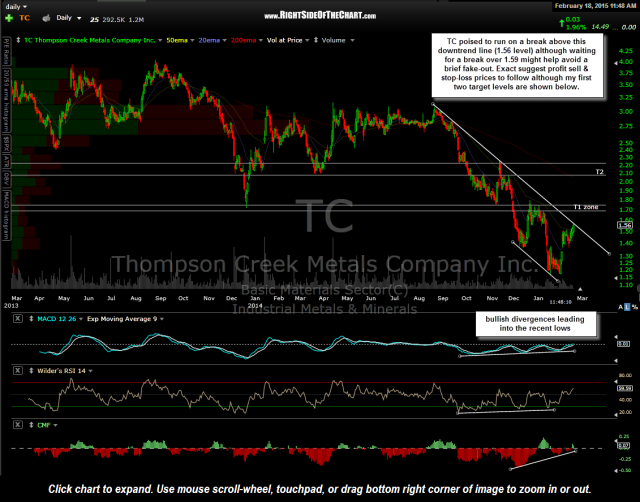

TC looks poised to run on a break above this downtrend line (1.56 level) although waiting for a break over 1.59 might help avoid a brief fake-out. Exact suggest profit sell & stop-loss prices to follow although my first two target levels are shown below. As such, TC will trigger a long entry on a break above 1.59 (trigger price 1.60).

On a couple of related notes, I am working on mocking up a few charts on some of the other individual rare earth stocks that look promising from either a short-term or long-term perspective (or both). Once again, my preference is to use a shotgun approach, buying relatively small positions in the individual rare earth stocks along with a core swing position/potential long-term trade in REMX.

Also note that following feedback from followers of the site (thank you!), Right Side of the Chart now has a Twitter feed (Randy Phinney@RSOTC). I am in the final stages of configuring the feed to automatically send tweets every time a new post is made to the site but where some might find additional value is the fact that I will now be able to very quickly (and with much less effort) send out tweets on developments in the markets, articles of interest that I come across, and most importantly, I will now be able to instantly send out out trade ideas that I come across throughout the trading session which I might decide to not post on the site.

Keep in mind that I don’t take every trade idea posted on RSOTC but I also take quite a few trades that I don’t post, often because the trade moved so fast upon triggering an entry that by the time I mocked up a chart, composed the post, compressed & uploaded the charts, etc…, the trade may have already moved beyond an objective entry level. Twitter users can follow the RSOTC feed by clicking on the icon at the upper-right hand corner of the site (desktop version, still working on adding the “follow” icons to mobile browsers). Please note that the social media icons, along setting up & using the Twitter & Facebook accounts (which I have never use before) are a work in progress at this point. As always, feedback & suggestions are welcome.