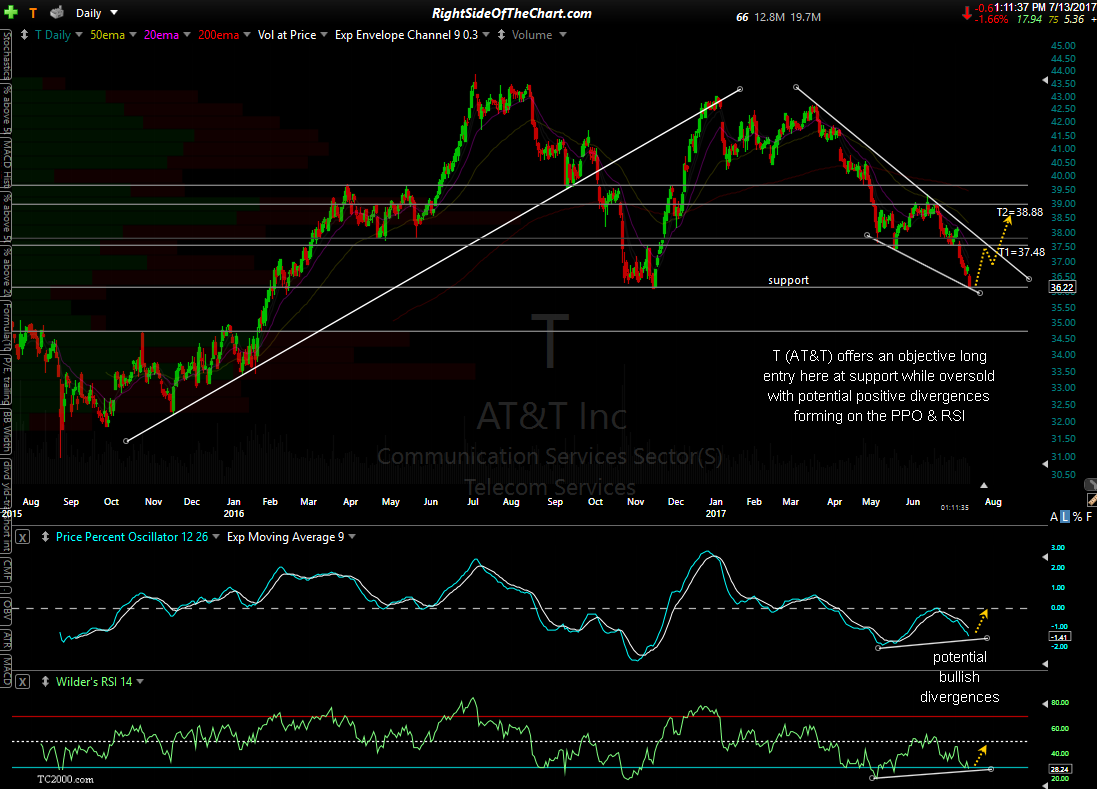

T (AT&T Inc) offers an objective long entry here at support while oversold with potential positive divergences forming on the PPO & RSI. With a current dividend yield of 5.36%, T will be added as an Active Growth & Income Trade (with the potential for additional price targets to be added) as well as an Active Swing Trade.

As there is a decent chance for a reaction off the initial downtrend line above, I might revise the first target to that level if the T starts to approach that level in the coming weeks. The maximum suggested stop (based on the final target) is any move below 35.40 with a suggested beta-adjustment of 1.0.