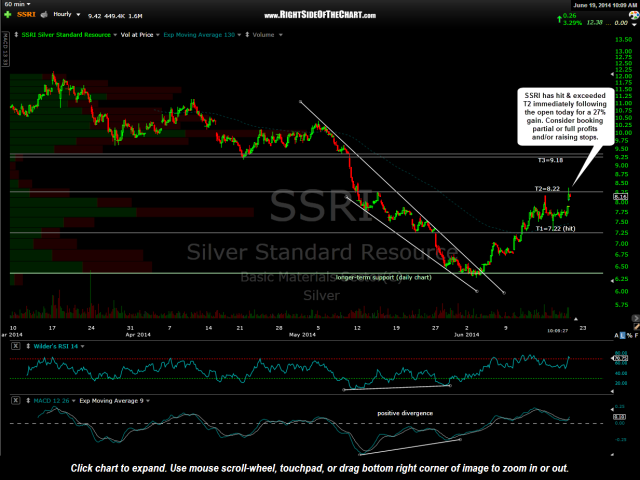

SSRI (Silver Standard Resources) has hit the second price target, T2 at 8.22, for a 27% gain since the entry just 12 trading sessions ago. SSRI is now very overbought in the near-term while at a significant resistance level which is defined by the bottom of a thin zone on the volume at price histogram (60 minute time frame).

Although overbought is not a reason in & of itself, especially on this particular stock considering its past trading history, the odds of at least a minor pullback and/or consolidation are elevated at this time. Whether one decides to ride out any counter-trend pullbacks or prefers to take partial or full profits here should depend on their unique trading style and pre-determined trading plan. Although today’s breakout in GLD & SLV does bode well for the mining stocks, keep in mind that they’ve already been rallying for weeks now and some of the miners may have gotten a bit ahead of themselves (relative to the move in the underlying metals). The first objective level to add back any shares sold here would be the bottom of today’s gap around the 7.90 area.